Explore How Leading Banks, Wealth Managers, and Insurers Earn Client Trust With Riva

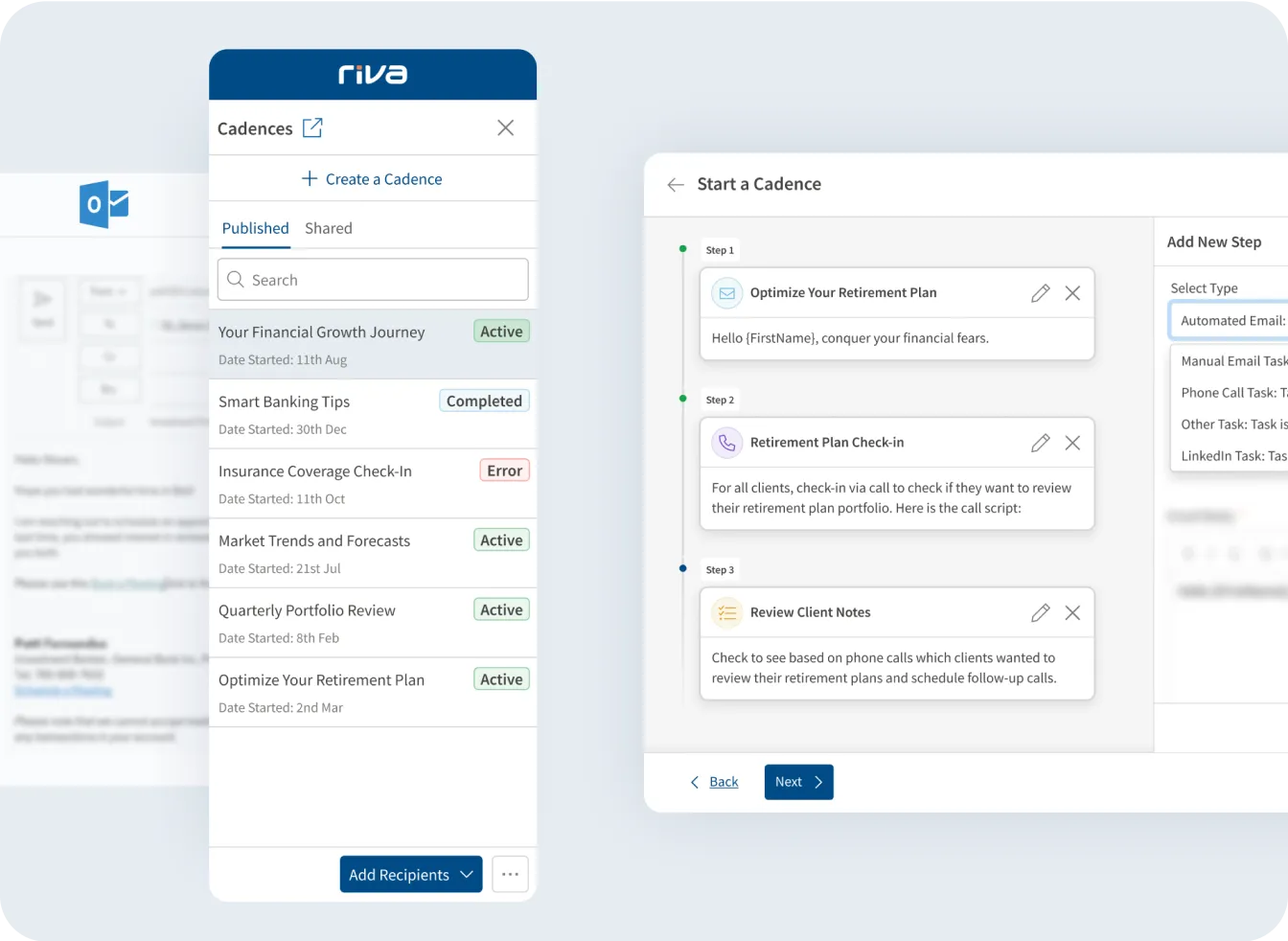

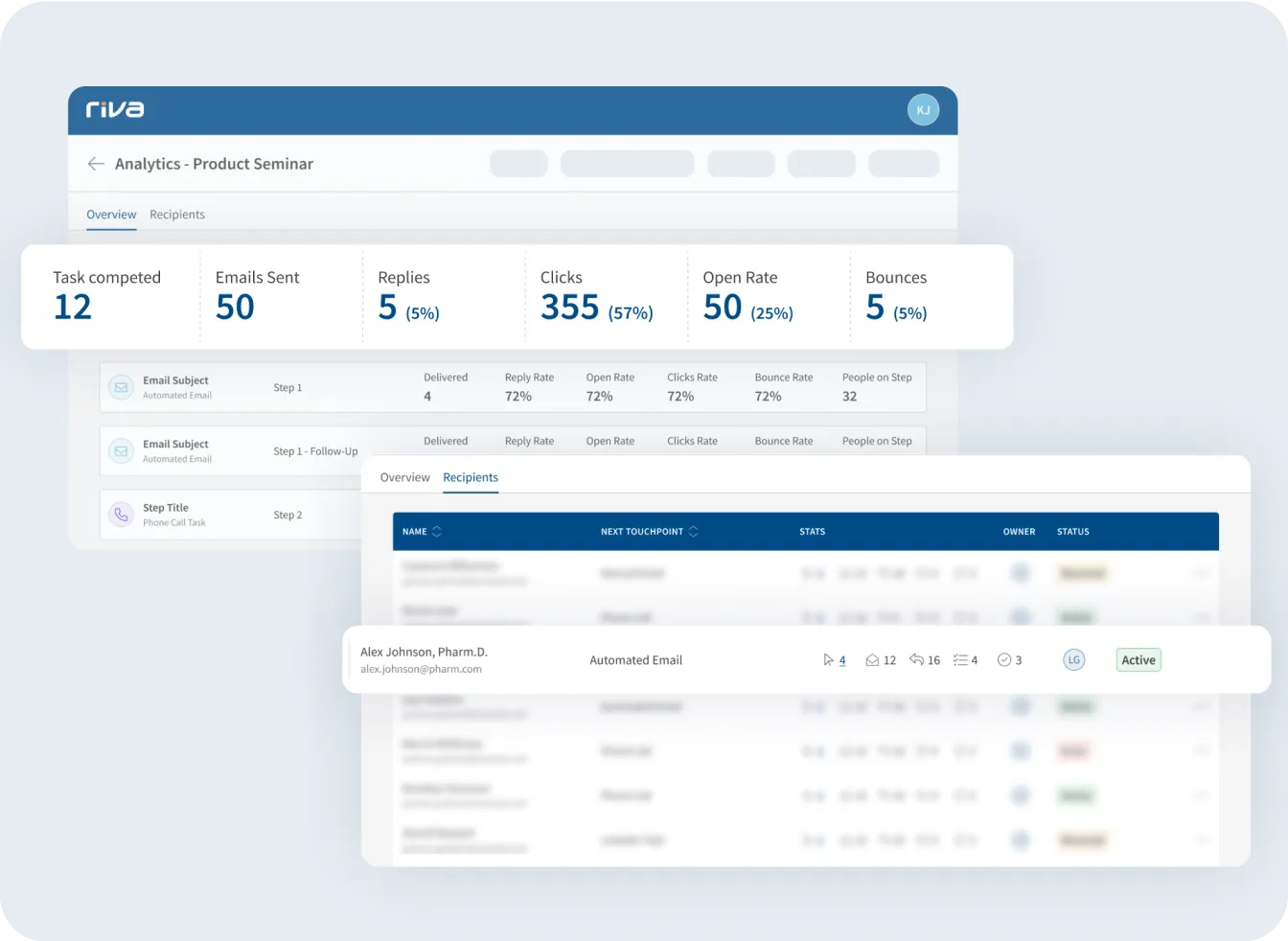

Build Long-Lasting Relationships

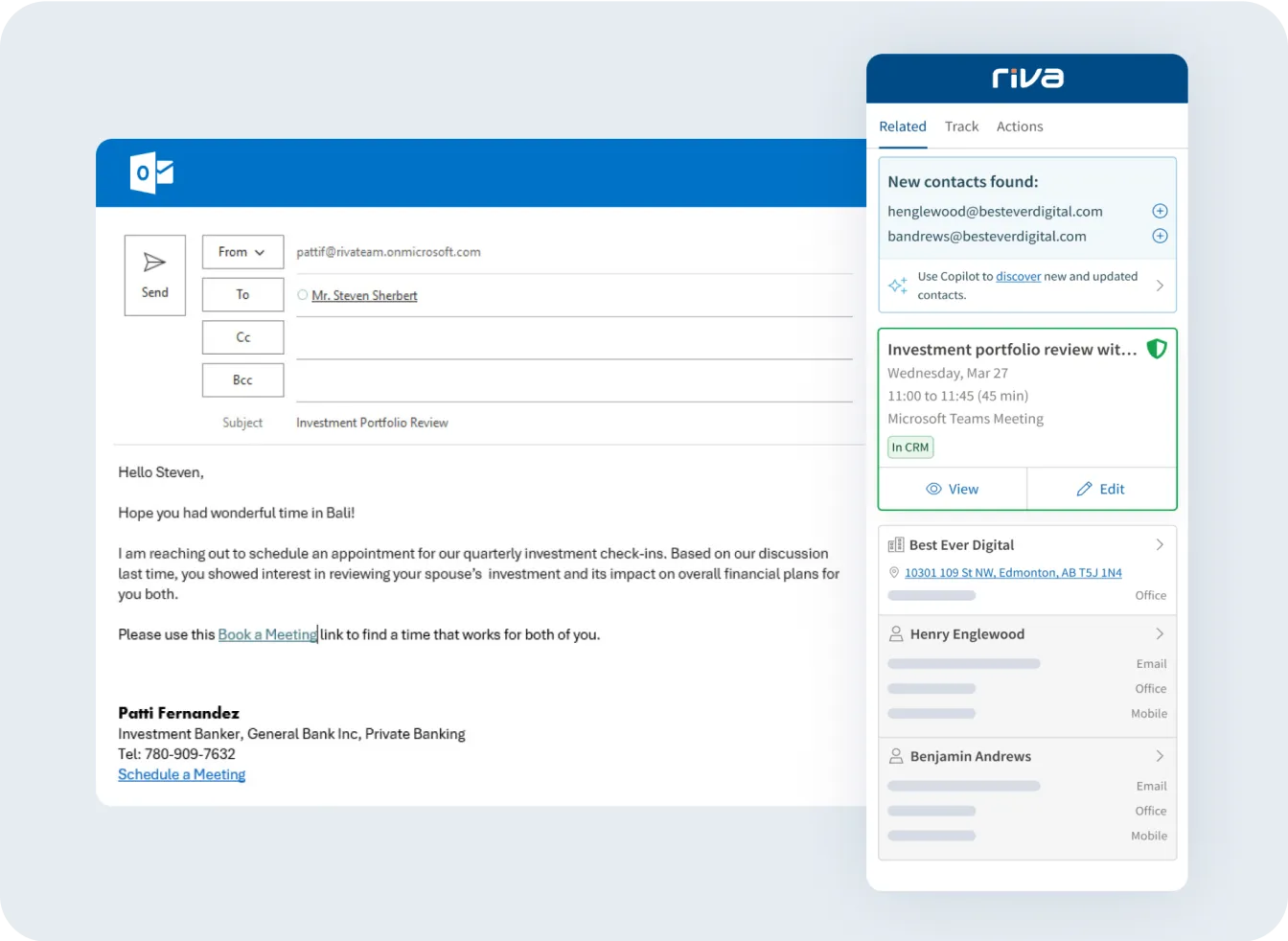

Elevate every client interaction with personalized, automated workflows that trigger the right message at the right time.

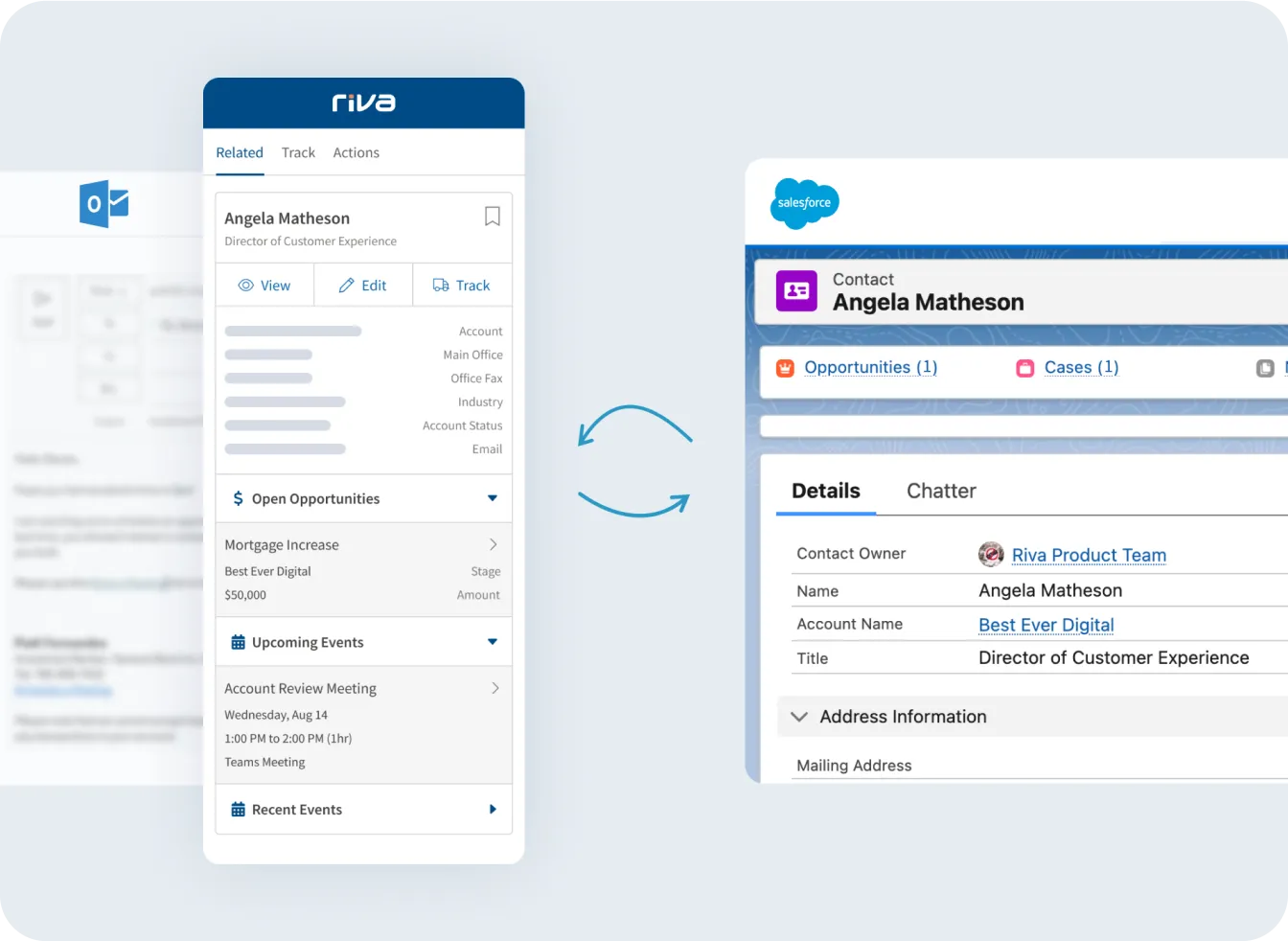

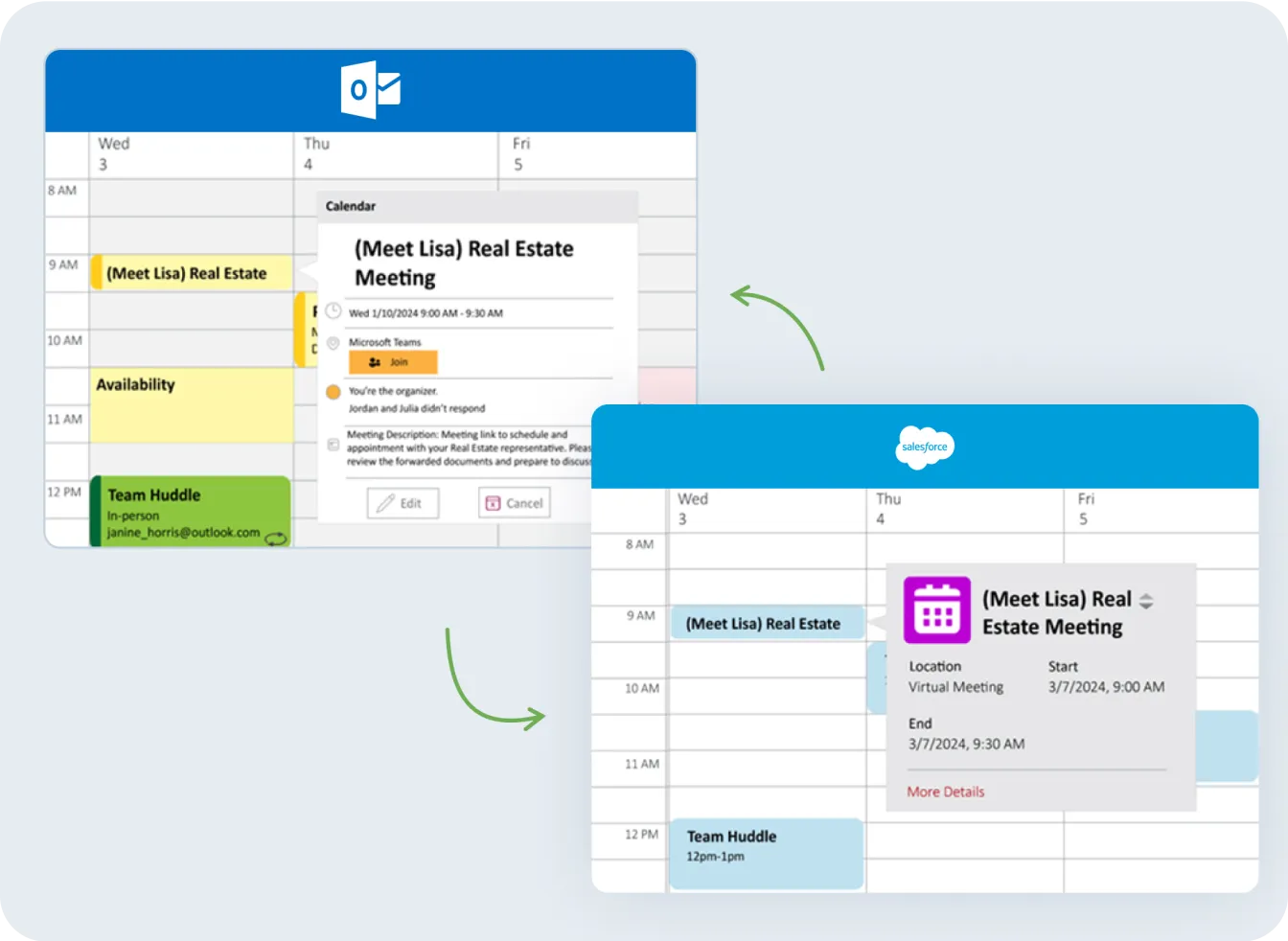

Increase Financial Advisor Productivity and Impact

Give advisors an in-depth look at financial accounts, goals, relationships, and more with one unified 360-degree view of clients.

Safeguard Your Clients and Your Reputation

Maintain 100% adherence to rules about accessing sensitive information like MNPI by securely controlling and classifying information.

Riva Empowers Financial Services Teams to Strengthen Client Relationships and Drive Growth

Download the Overview: Transforming CRM Efficiency for Financial Institutions with Riva

Riva automates Outlook and CRM data sync, so financial institutions can do better work in less time. Discover how reclaiming advisors’ time with Riva helps build customer relationships and deliver results.

“Riva has helped us mitigate the risk of losing the trust of our valuable high net-worth clients. Our bankers and wealth managers no longer waste time toggling between systems.”

Speak to an Expert

Learn how Riva can help you reclaim your day and confidently follow through with clients.

Contact Us