Transformative Impact is Worth the Investment

At Riva, we’ve spent decades building an impressive list of clients who rave about our Revenue Data Operations platform’s positive impact on their people, processes, data, and customers. The frustrating part for our team is that security concerns prevent most of these clients from sharing these stories with you.

That is why we commissioned Forrester Consulting to do a Total Economic Impact™ (TEI) study for Riva: to tell the story our clients can’t.

The results were positive. The Forrester Consulting team interviewed four long-time enterprise clients in Financial Services and Pharmaceuticals. Using data from those interviews, the Forrester team applied a financial model to a composite enterprise and concluded that an investment in Riva:

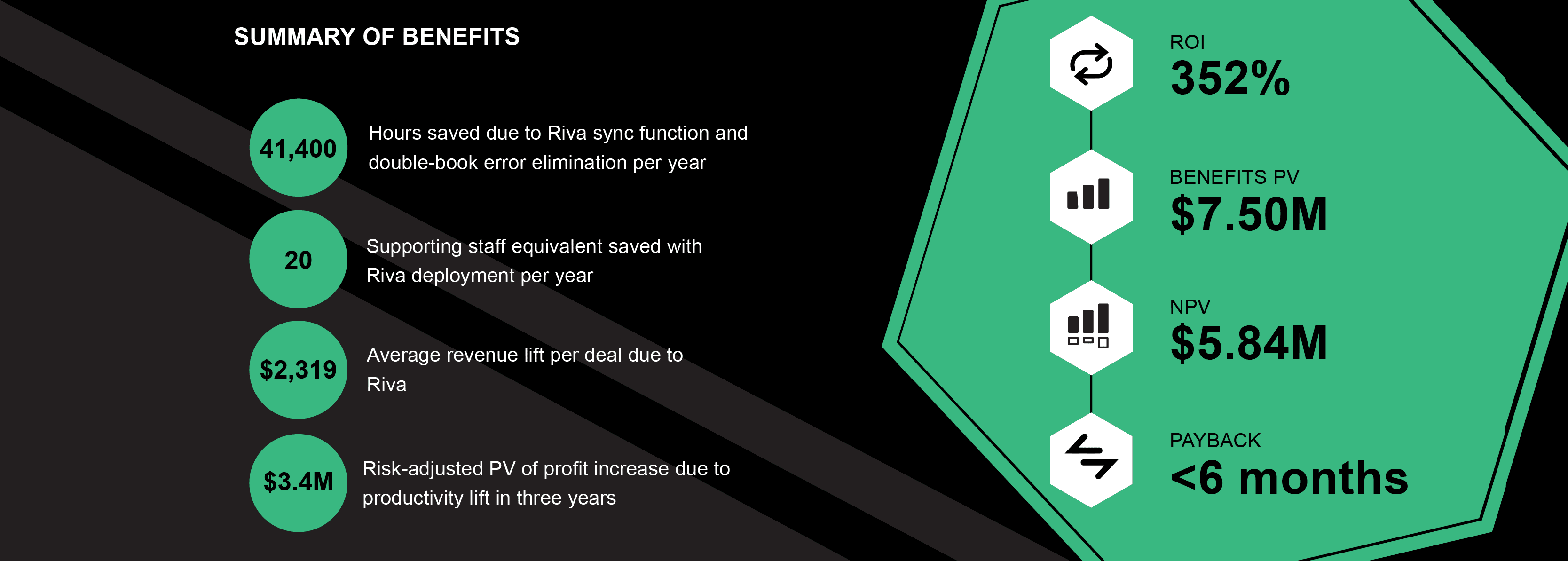

- Produced a 352% Return on Investment (ROI)

- Enabled the company to generate an incremental profit increase of $3.4M in sales over three years

- Resulted in a payback period of less than 6 months

How the Forrester TEI Study Works

Before we dive into the findings and implications of Riva’s TEI study, it’s essential to understand how the Forrester Consulting team arrived at their conclusions. And while reading the 21-page study covers this in detail, this section summarizes the Forrester Consulting study’s in-depth analysis and results. The Forrester Consulting team endeavored to:

Gain a Basic Understanding of Riva’s Business. Today’s enterprises gather enormous volumes of customer and related data in the course of doing business. A growing number of platforms collect revenue and communications data—including CRM platforms like Salesforce and email, calendar, and contact platforms like Microsoft Outlook. To avoid data isolation in disparate data silos, organizations have three major options:

- Force teams to manually transcribe data collected in one platform into the other (time-consuming and error-prone)

- Do nothing and move ahead with incomplete data (risky given long-term client relationships)

- Invest in a data operations platform like Riva (as validated by the Forrester report—a choice with meaningful economic impact)

Interview Four Riva Clients. To analyze the efficacy of Riva’s solutions, Forrester surveyed four long-term Riva Clients—three global banks and one pharmaceutical company—by interviewing key stakeholders to establish baseline information on Riva’s impact.

Build a Composite Organization. In the interest of preserving the anonymity of the Riva customers interviewed for the study, the Forrester team used the data gathered during their interviews and applied their trademarked approach to create a composite corporation with a representative financial outcome.

Apply Economic Drivers to Riva’s TEI Analysis. Forrester’s TEI analysis focused on four elements to gauge Riva’s theoretical impact on the composite organization: benefits, costs, flexibility, and risks.

Create a Composite Organization and related financial model based on the Four Clients. Forrester’s composite organization is an accurate reflection of the four global banks that are Riva clients. The following characteristics were applied to the Composite Organization:

- Financial services company with headquarters in the U.S. with $2.25 billion in annual revenue

- 750 client-facing advisors across the wealth, asset management, and commercial banking departments who use Riva.

- Each advisor manages a portfolio with 100 client accounts and 400 contacts (a total of 40,000 contacts). Advisors communicate with each contact approximately five times per year.

- Each advisor generates an average of $3.01 million in revenue per year, with $23,192 average revenue per deal.

- The composite organization’s communications stack operates on Outlook and uses Salesforce CRM

- This organization used Riva for Data Compliance, deployed in a dedicated cloud instance with the Riva Insight sidebar to increase data observability. It also implemented all of Riva’s industry best practices and governance configurations designed to protect against the inadvertent sharing of Material Non-Public Information (MNPI).

The Results: Distilling Riva’s TEI

For those inclined to read the end of the book before the beginning to better understand the story, the graphic below cuts straight to the Forrester Consulting study’s findings. For the rest of you? Consider this a spoiler alert.

This chart, of course, is what Forrester Consulting concluded in their three-year, risk-adjusted present value TEI analysis of the composite organization. The study goes into much greater detail on the why. And because context is essential to understanding, we’ve included a quick glimpse at their key findings:

- Riva’s automated Outlook-to-CRM synchronization saved the composite organization’s CRM users the time equivalent of 18 full-time employees —equal to $3.72 million in recaptured time

- Riva’s real-time calendar sync eliminated double-booking errors and saved the composite organization the equivalent of 3,900 hours per year –for a total three-year savings of $412,000. Together, over this three-year period, Riva saved 124,200 working hours.

- By capturing and unifying customer and deal data to provide true Customer 360 to key end-users, deploying Riva delivered 5% faster revenue realization —adding 21 more deals and $3.36 million in increased profit over three years

TEI Deep Dive: The Benefits of Riva Deployment

Based solely on the quantifiable conclusions of the Forrester Consulting study, Riva’s impact on end-user productivity, scheduling, and Customer 360 paid back its cost within six months. The study also uncovered unquantifiable but equally important and impactful benefits for the IT and operations departments including ability to scale, the flexibility that enterprises demand, and a deeper understanding of how to comply with industry regulations.

Without exception, each of the four enterprises acknowledged the overall challenge they faced in realizing their CRM’s promise. After deploying Riva, they achieved what other options—from CRM-native integration apps to in-house-built solutions—promised but failed to deliver.

The moral of the story? Choosing the right approach to revenue data operations can have a significant transformative impact. And based on Forrester’s findings, we believe the results described by the four surveyed enterprises were transformative and replicable—offering forward-working, industry-leading, and committed enterprises the opportunity to:

- Support long-term customer relationships. In complex industries, customer relationships take shape over months and years—and each new interaction builds on those that came before. By unifying, governing, and securely distributing customer-related deal data, our revenue data operations solutions ensure that client-facing teams have access to current, comprehensive information to serve their customers better. Over time, as relationships grow, high-quality data enables advisors to anticipate customer needs, cross-sell new products, create high-quality customer experiences, and ultimately increase customer lifetime value.

“Through a frictionless experience tracking client interactions and upcoming meetings, we get information that allows us to make better decisions on how to service the client.” – Vice President of Business Intelligence, Global Financial Services Organization, The Total Economic Impact™ of Riva

- Create a tech stack that works together. Our customer data operations platform functions as an enabling layer of the current enterprise tech stack. Without it, CRM will not realize its potential as the single source of trusted customer data. Automating data capture, unification, and distribution between CRM and communications stacks (like Outlook) where end-users prefer to work increases CRM adoption and decreases the risk of incomplete, inaccurate, and untrustworthy data.

- Work confidently with a partner that specializes in Financial Services. From the company’s inception, Riva’s technologies were designed to meet the complex requirements of financial services clients. Today, more than 200 global banks, insurance companies, and a range of enterprises in other regulated industries rely on Riva to ensure their customer and deal data is complete, accurate, timely, and in compliance with industry regulations.

“I considered other companies out there, [but] we’ve been partnered with Riva for a while and we love it, and it’s fairly inexpensive. So, it seems like a no-brainer.” – Program Manager of CRM Technology, Global Financial Services Organization, The Total Economic Impact™ of Riva

- Deploy a scalable platform to support enterprise demands. Because Riva primarily serves demanding global enterprises, our platform is designed to scale as our customers roll out our solution across various divisions and lines of business. Our largest deployment has over 65,000 end users who benefit from transparent synchronization of email, calendar events, and contacts all day, every day, without fail.

“One of the key reasons we selected Riva was for [its] ability to scale across large numbers of users within our consumer bank as well as large populations of users across other related business units.” – Program Manager of CRM Technology, Global Financial Services Organization, The Total Economic Impact™ of Riva

- Accelerate the deal cycle. Based on Forrester Consulting’s analysis, a Riva deployment sped revenue realization by 5%. The rationale is straightforward: unified data drives improved customer relationships, more robust customer retention, improved cross-selling opportunities, and faster transactions—all fueled by higher end-user satisfaction and productivity that increased revenue growth.

“Riva incents people to get their client interactions into the CRM so we can better cover the account,. [That way,] we know what is happening with the account across all our regions, products, and services, and [we] can take advantage of cross-marketing [and] cross-selling opportunities.” – VP of Business Intelligence and CRM Services, Global Financial Services Enterprise, The Total Economic Impact™ of Riva

- Enhance the Focus and Productivity of Client-Facing Teams. Riva’s data operations platform automates the unreliable, time-consuming process of manual data transcription that too often plagues client-facing teams. After Riva, these revenue producers have access to high-quality data without an impact on their productivity. Riva Insight surfaces CRM data into an integrated Outlook sidebar with create, read, update, and delete capabilities. By bringing these capabilities into the workflow and processes financial advisors prefer, they no longer have to switch tasks and applications – and their productivity naturally improves.

“We know that no matter how hard we try, there will be some people who will just never gravitate towards CRM. And the last thing I need is yet another system.” – VP of Business Intelligence and CRM services, Global Financial Services Enterprise, The Total Economic Impact™ of Riva

- Curate, maintain, and deliver trustworthy data. Data trust begins with data quality—an enterprise goal Riva is designed to deliver. By unifying revenue and communications data and distributing it to the CRM, email, calendar, and contacts platforms where end-users live and work every day, Riva eliminates the need for manual data entry—and the errors, duplications, and omissions it can cause. Riva Insight further bolsters data quality by allowing end-users to verify and update customer data across platforms from a single point—without toggling between those platforms. Riva also provides robust data oversight and governance, bolstering data observability to resolve data issues before they negatively impact data quality. This in turn, provides increased employee satisfaction and retention. Because advisors have more confidence in the data, insights, and simplicity provided by their systems, they experience greater success and are less inclined to take their talents elsewhere.

“Riva helps to convince reps to work with the system. They have this [Riva] Insight bar that brings flexibility. They can color code things. [They can work on] very simplistic things, but the reps like it and it is effective. So, that is increasing adoption, and the efficiency is avoiding errors [and] avoiding double bookings.” – Portfolio Manager, Global Pharmaceutical Enterprise, The Total Economic Impact™ of Riva

- Ensure compliant data operations. Most of our customers capture enormous volumes of sensitive customer data. And in many cases, the use of that data is subject to strict government regulation. In light of those demands, Riva solutions ensure compliant data operations through pass-through architecture and robust administrative and governance tools. Riva also offers specialized configuration capabilities to manage MNPI.

- Boost end-user adoption. Enterprises have long regarded CRM as a corporate panacea: a powerful technology that would serve as a single source of truth for end-users to engage with customers and prospects. But corporate communications stack applications continue to multiply—creating data silos and an ever-growing need to manually transcribe essential customer data to CRM. The reality is that CRM data is often rife with errors, omissions, and duplications resulting in poor data quality and an adverse effect on CRM adoption. By automating data capture and improving data quality, we reverse this situation, significantly improving CRM adoption.

“Adoption is definitely one of the key things, because we have some other newer lines of business, and that is what we would call table stakes: we have to have the sync in place. Otherwise, the advisors would not adopt, because they’re not going to enter meetings in both places.” – Program Manager, Financial Services, The Total Economic Impact™ of Riva

In a sense, our decision to commission a Forrester study of Riva’s Total Economic Impact™ is analogous to the investment enterprises make in Riva revenue data operations: Both signify an eagerness to learn—and grow. Both involve risk—and a certain level of courage that the investment leap will pay off. But most important, both represent confidence in the fundamental promise and potential of our business.

We believe in Riva because we see our revenue data operations solutions’ impact on customers worldwide. We’re proud and excited that, in our eyes, the Forrester Consulting TEI confirms what our customers experience—and share with us year after year. We hope it encourages prospects to explore our capabilities further. And we’re hoping you’ll take the time to download The Total Economic Impact™ Of Riva: Cost Savings and Business Benefits Enabled By Riva to dig deeper, learn more, and consider Riva for your enterprise—because transformative impact is worth the investment.

“With a Riva deployment, companies experience time savings, productivity lift, and faster revenue realization.” – The Total Economic Impact™ Of Riva: Cost Savings and Business Benefits Enabled By Riva, A commissioned study conducted by Forrester Consulting on behalf of Riva, February 2023