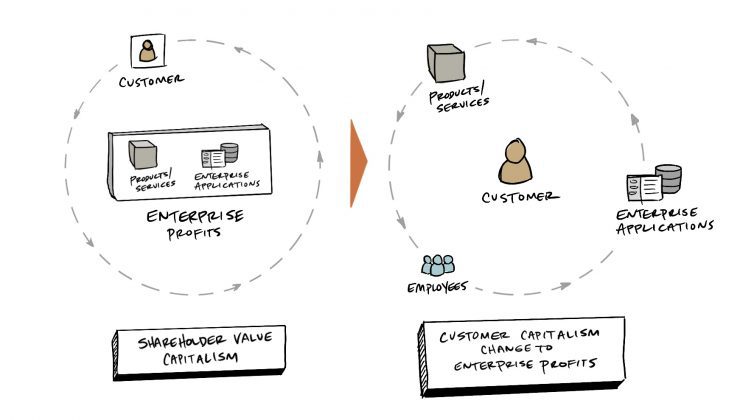

The concept of shareholder value capitalism is attributed to several notable economists and embraced as conventional wisdom by Western culture in the mid-1970s. This philosophy placed corporations, their profits, and ultimately shareholder returns at the economic center of the universe. After decades of broad acceptance, it’s starting to fall out of favor.

Management philosopher Peter Drucker theorized that profits and shareholder value were the direct results of delivering value that served customer needs, not vice versa. Jack Welch, the legendary ex-CEO of GE, concurred, adding, “on the face of it, shareholder value is the dumbest idea in the world.” “There are only two sources of competitive advantage: the ability to learn more about our customers faster than the competition and the ability to turn that learning into action, fast.”

By placing customer value at the center of their respective universes, fast-growing companies worldwide (look no further than Apple, Amazon, TikTok, or Netflix) demonstrate the potential of customer capitalism. These companies leverage customer data to learn about their customers and turn that knowledge into action faster – the basic recipe for a successful digital transformation.

Digital transformation is no easy task, however – even for progressive corporations. Customer capitalism represents a sort of Copernican revolution, one that forces many corporate structures, practices, and software solutions to complete the 180-degree shift from a shareholder centric approach to a customer centric approach.

Customer Data Operations: Transforming Hidden Data Into Golden Opportunities

Fortunately, most organizations gather all kinds of customer data that could be used as a source of competitive advantage – if only the data were available where and when they need it. Customers leave digital footprints in the applications your employees use most – their calendars and inboxes. In the past, this critical customer relationship data was traditionally stored in ERP or accounting systems. The expectation was that important customer information would make its way into the corporate Customer Relationship Management System (CRM). Unfortunately, customer data gets trapped in applications and platforms that were not designed to support the initiatives of a customer-centric corporation.

That’s where customer data operations (“data ops”) comes in.

Given the fundamentally human nature of corporate communication, systems and applications designed during the era of shareholder capitalism are rich with customer information. However, that information gets trapped in functional or divisional silos and often lacks the nuance and context of the company’s 360-degree view of the customer.

“As far back as 15 years ago, we observed our clients were becoming increasingly aware that their customer data held a lot more potential than their technology allowed them to access and use,” says Aldo Zanoni, Riva’s co-founder, and CEO. “As a young software development firm, we were at the right place at the right time. We quickly earned a reputation for building a platform that helped our customers tap the gold hidden in their customer data, data that was trapped by their technology.”

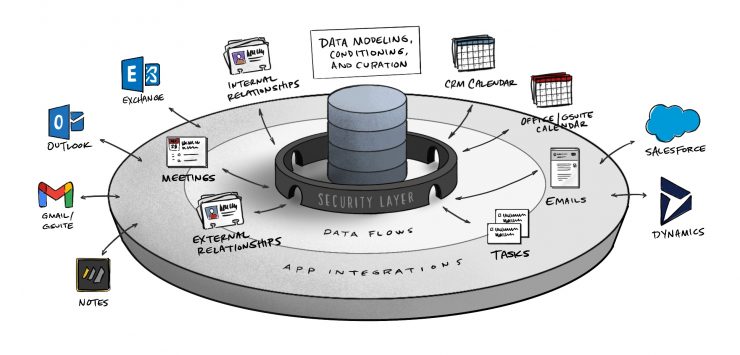

Riva is at the forefront of a growing movement to provide customer-centric data ops. With customer data operations, corporations can now separate their data from the software where it’s housed. Robust data ops allow corporations to abstract essential customer data from emails, contacts, and meeting invitations and place it into the context of conversations, relationships, and collaborations. After considering data privacy and security compliance requirements, the enriched data can flow back to employees inside the applications they use every day, so they are better prepared to create value for the customer – during each experience.

Smart, Secure, Data Integration at Scale

“From the customer’s perspective, data ops are essentially invisible,” says Aldo Zanoni. “When data integration is working as it should, enterprise team members have a more complete, current picture of each customer. When a customer calls, the corporation can do a much better job of anticipating and addressing their needs. Data ops puts the right data into the hands of the right employees to improve the customer experience. It also helps executive leaders to make better decisions because the data is more curated, complete, and can be understood in the context of the customer’s relationship with the enterprise.”

In the simplest terms, data ops democratize data by eliminating the workflows and use constraints imposed upon it by specific applications. Because the data gathered by corporations is often sensitive and/or regulated, unbridled democratization can create enormous security and compliance risks. As a result, gathering, analyzing, and grooming data to create customer value is only the first step in the process. The next step is to leverage that data by governing access – and taking steps to ensure the secure and compliant use of privileged customer data.

“Our pass-through technologies free data from the software applications where it’s initially gathered and housed,” says Stéphane Zanoni, Riva’s co-founder, and CTO. Once the data is abstracted, it is no longer subject to the technical limitations of the system that collected it.

“Once we’ve abstracted the data, its potential is limited only by imagination,” says Stéphane. “But because the data is gathered from customers, corporations need to temper imagination with responsibility.”

Ensuring customer data security is a core responsibility of corporations in the era of consumer capitalism. It is mission-critical in regulated industries like finance, insurance, healthcare, life sciences, and government. Choosing a proven customer data operations partner demonstrates a corporation’s commitment to keeping customer data safe. It is also a safeguard from sanctions and reputation damage associated with data misuse or breach. “Clients rely on us to honor the data security promises they make to their customers – and to make sure their data use is compliant with current regulations,” says Stéphane.

A New Layer in the Digital Transformation Technology Stack

As the move toward customer capitalism has accelerated, corporations have recognized the growing power of the consumer and the limitations they face with software developed for a shareholder-centric approach to business. CRM and cloud providers moved to fill that gap, but without access to customer data housed in email, calendar, contacts, and tasks, their customer insights were often untimely and incomplete.

Given this reality, many CRM providers developed simple connectors designed to bridge the gap. Unfortunately, those solutions lacked the sophistication necessary to accomplish meaningful customer data integration at scale.

“Our CRM partners are very good at what they do – but they don’t do what we do,” says Stéphane Zanoni. “With the growing availability of high-performance customer data ops solutions like our Relationship Engine, CRM providers are sunsetting the solutions they’ve created. At this point, they know that what we do ultimately enhances the value they’re able to bring to their customers. Now CRM providers are among our strongest referral sources.”

“It’s a win for everyone involved,” says Stéphane. “We’re able to focus on improving the security and efficiency of our data operations platform, the Riva Relationship Engine. CRM providers are able to focus on improving the power of their solutions. Customers can then enjoy more responsive products and services, and corporations can continue their successful transition to an increasingly customer-centric marketplace.”

After decades of tuning systems, cultures, and expectations toward consumer capitalism, customer data operations has emerged as a new layer in the technology stack, designed to accelerate digital transformation for companies of all sizes. Based on the momentum of this revolution, there’s never been a better time to be a customer.