Riva for Financial Services

Amplify Advisor Success with Customer 360 and Automated Workflows

Transform your operations so advisors, brokers, and sellers can capture client activity and relationship data in real-time at scale, optimize every touchpoint along the customer journey, and deliver brilliant digital experiences.

Why Financial Organizations Choose Riva

Riva has solved challenges for over 200 financial service enterprises like yours over the last 12 years, including six of the top ten banks in the US and Canada. Deep industry expertise, ability to capture data at scale in real-time, and ironclad security, privacy, and compliance come standard with Riva.

Advisor Workflows and Customer Data Right in Outlook

Easily capture and view all client data right in Outlook. No more task switching and time-consuming manual data entry. Automated advisor workflow capabilities, like email bursts and cadences right in Outlook free up time so your teams can focus on providing the best advice to their clients.

Personalized Digital Client and Employee Experiences

Optimize every touchpoint along the client journey and effectively follow through to increase customer lifetime value. Riva helps effortlessly schedule meetings, craft personalized client content, and deliver high-value customer and employee digital experiences at scale.

Unlock the Full Story of Client Relationships

Say goodbye to poor data quality and time wasted on data wrangling with a unified view of trusted customer 360 data. Riva prioritizes signal over noise and helps create a long-term memory of all client relationship data so every client feels like they’re the only one in the room without overburdening the advisors.

Trusted By

Financial Services Expertise

Whatever your financial focus, Riva can help you streamline operations without compromising client relationships and ensuring data security and compliance. See why Riva is trusted to keep $32 trillion in assets under management (AUM) secure.

Take the guesswork out of higher client lifetime value

Help clients achieve – and surpass – their goals by anticipating opportunities, recognizing needs, and recommending next actions with AI-powered insights.

Boost client engagement to grow book of business

Build trusted client relationships with timely, personalized communication and touchpoints.

Connect clients and advisors seamlessly

Help advisors spend more time interacting with clients by automating manual tasks and taking the hassle out of meeting scheduling.

Ensure full visibility into clients’ portfolios

Deliver true Customer360 insights to asset managers’ fingertips and empower them to fulfill their fiduciary duties more easily.

Grow book of business and AUM with automation

Empower asset managers with data-driven automations to seamlessly augment client lifetime value and increase managed assets.

Deliver premium, personalized client experience every time

Build trusted client relationships from the start with tailored client interactions and timely touchpoints across channels.

Enhance cooperation across “deal teams” – securely

Enable seamless collaboration among team members, while keeping sensitive data secure with built-in compliance.

Identify key relationships with Customer360

Benefit from true Customer360 to better understand clients and prospects insights, relationships, and interactions.

Optimize processes for a shorter time to value

Leverage automation and analytics to simplify processes, improve pipeline, and enhance client engagements.

Win more deals every quarter

Leverage AI and automation to improve relationship managers’ productivity and enable them to see more clients.

Unify the customer experience across the bank

Connect the banking experience with unified customer data and consistent client experience across channels.

Improve customer engagement at scale

Automate mass reach outs and personalized touchpoints with email bursts and sales cadences for a higher customer engagement.

Connect clients and advisors seamlessly

Help advisors spend more time interacting with clients by automating manual tasks and taking the hassle out of meeting scheduling.

Boost client engagement to win more deals

Build and maintain trusted client relationships with timely, personalized communication and touchpoints.

Unify the customer experience across the organization

Connect the insurance experience with unified customer data and consistent client experience across channels.

Industry Recognition

Flexible Integration for Financial Sector

Riva offers the most flexible relationship and sales engagement solution – designed specifically to meet the needs of financial enterprises. Whether you’re using Salesforce with Sales or Financial Services Cloud, or another CRM, Riva can help.

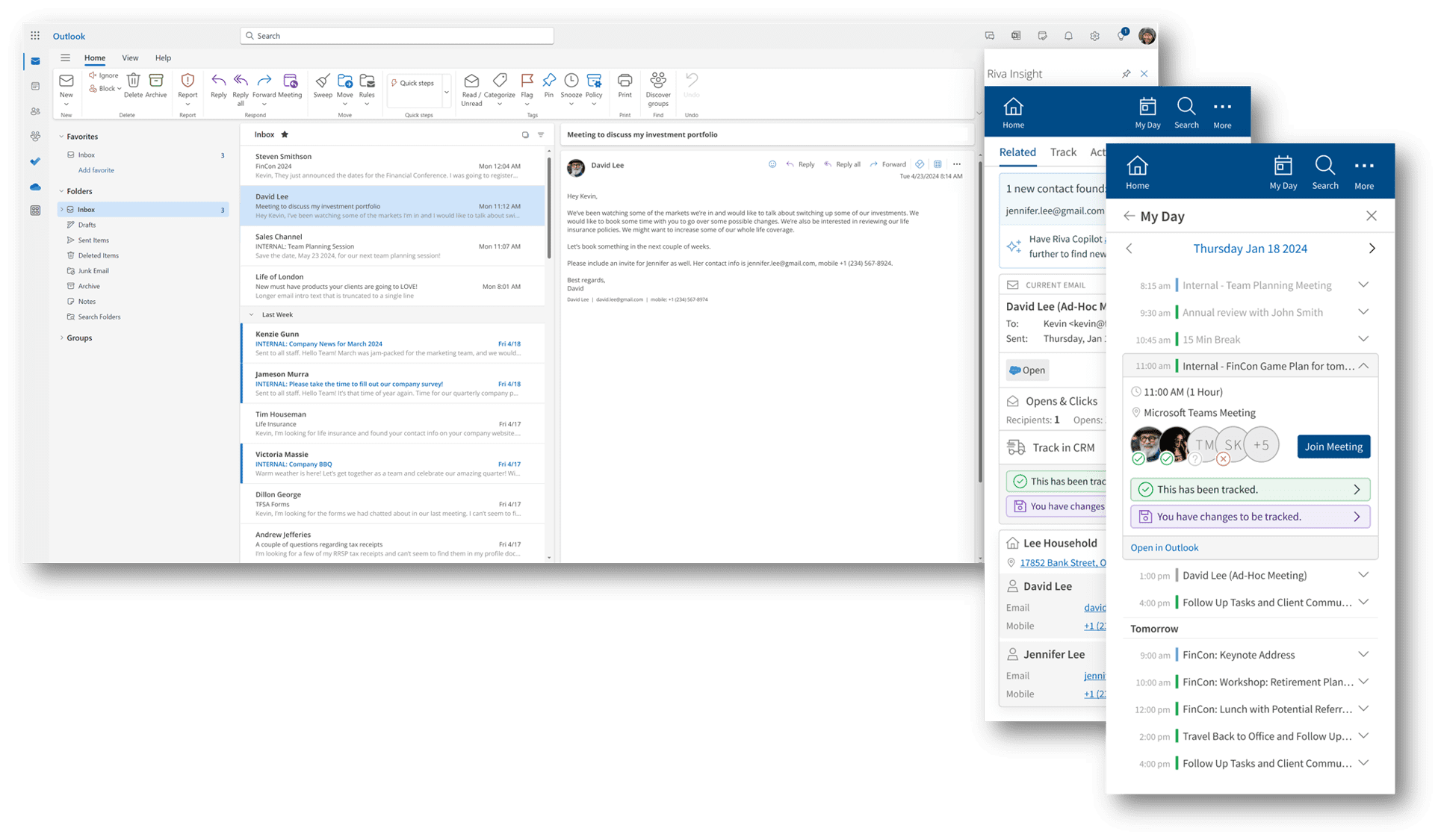

CRM Data and Advisor Workflows Directly in Outlook – No More Task Switching

Easily capture and access customer data in Outlook and put customer relationship data right in the workflow advisors use the most. Enhance transparency and collaboration with effortless email, contact, and calendar sync for complete customer 360 data. Transform team workflow with powerful technology that brings all the right information to where your teams want to work, no more task switching or wasting time looking for customer information.

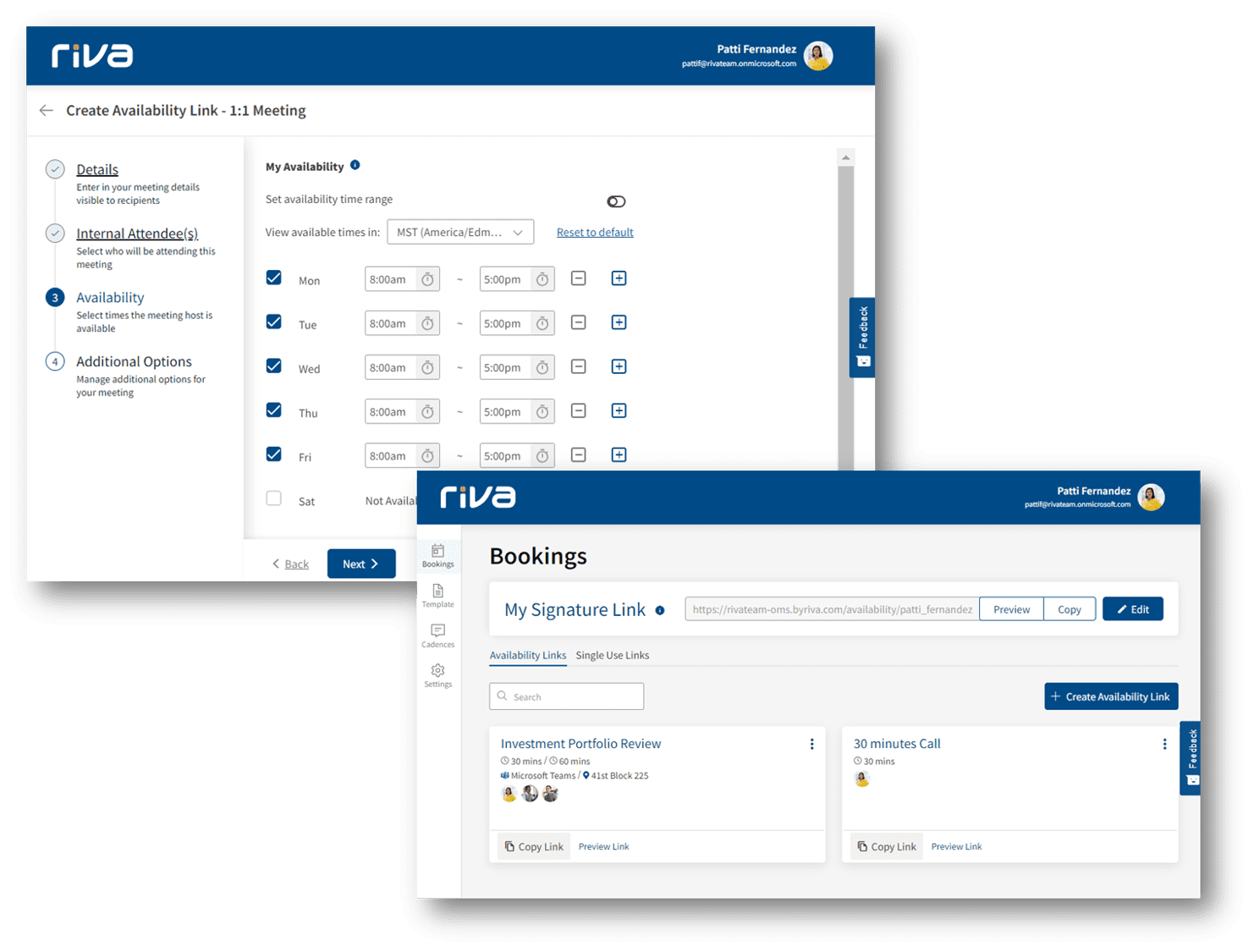

Reduce Meeting Scheduling Friction

Remove the back-and-forth emails and friction of scheduling a meeting and deliver an optimized client experience while standing up to rigorous enterprise requirements with Riva Bookings. Easily share your availability and create delegate links that are actionable right from Outlook as a part of your current advisor and seller workflows.

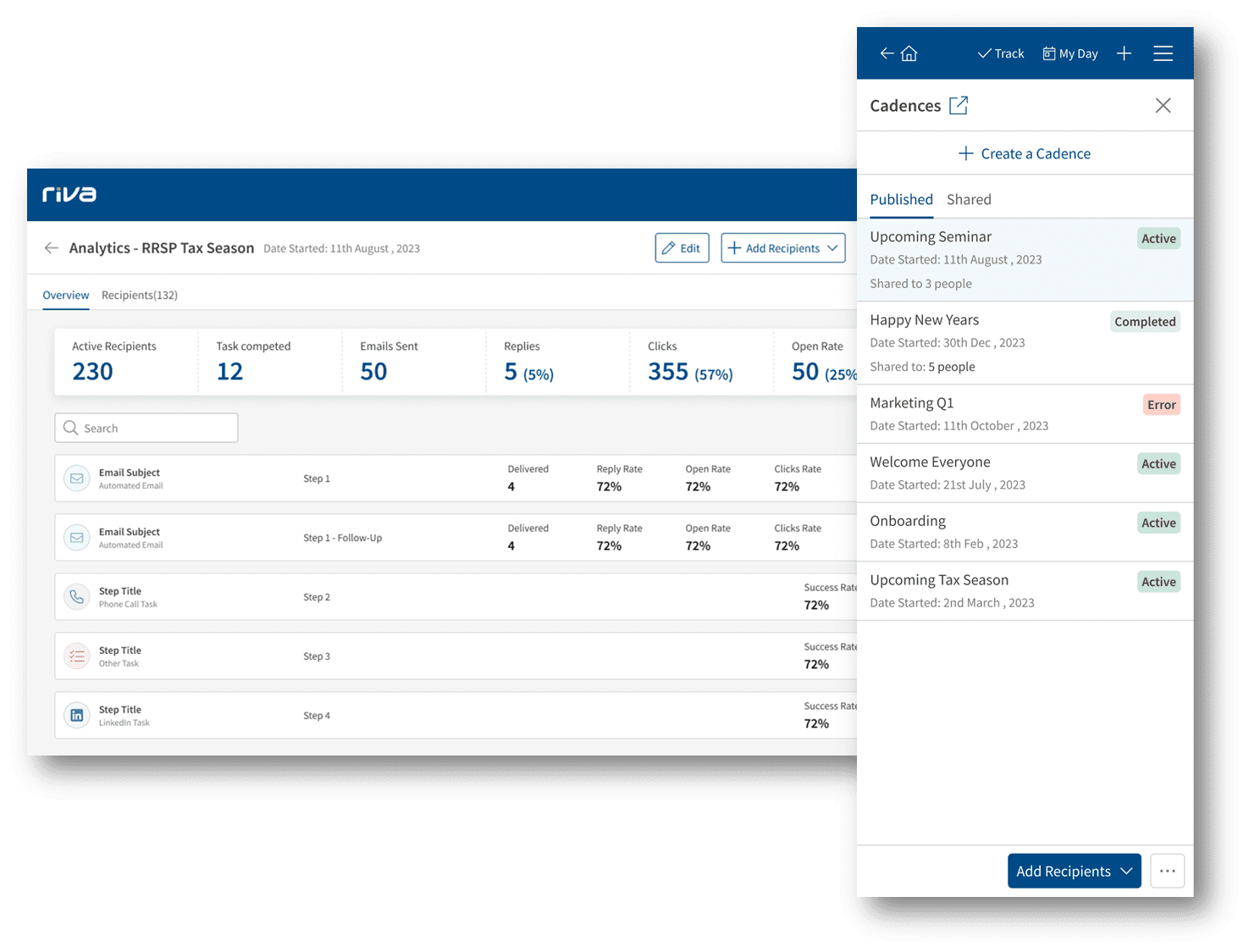

Unlock Data-driven Client Engagement at Scale with Cadences and Engagement Analytics

Empowering financial advisors and sellers to deliver brilliant client experiences with the right message to the right client at the right time, Riva enables personalized and scalable client interactions right from Outlook. Advisors can provide the best advice to their clients through integrated relationship and engagement analytics that deliver insights into client behavior and enable data-driven decision-making.

Eliminate Data Gaps and Optimize your Email Content with Riva Copilot AI Assistant

Tired of missing and incorrect data and manual data entry? Riva Copilot monitors and scrapes contact data from emails right into your CRM, ensuring real-time accuracy and transforming your customer database into a goldmine of relevant, actionable data. Optimize your email campaigns with our AI content writer that crafts compelling, personalized content for higher engagement and conversions.

Connect with Riva

Every Relationship Counts

Empower your advisors, streamline operations, and drive revenue growth with Riva’s tailored approach to financial services.