Guest: Michelle Feinstein, Vice President of Global Wealth Management Solutions & Strategy at Salesforce

Today’s episode is hosted by Betsy Peters. She is joined by Michelle Feinstein, Vice President of Global Wealth Management Solutions & Strategy at Salesforce. They talk about how to balance the conversation between technology and strategy, how to gain trust as a brand, and why teaching customers how to use tools is more important than creating new ones.

Michelle Feinstein’s 25+ years of experience gives her a unique perspective on how firms will be successful as they try to leapfrog from Wealth Management 1.0 to 3.0 over the next five years. In her current role, leading Industry Solutions and Strategy for Global Wealth Management at Salesforce, she sits at the epicenter of strategy, working in collaboration with product, partnerships and sales teams to define the vision and product roadmap for this segment. Watch the full video on YouTube or read the transcript below!

Subscribe and listen to the Rev-Tech Revolution podcast series on:

Speaker 1 (00:07): Welcome to the Rev Tech Revolution podcast. Today’s episode is hosted by Betsy Peters. She is joined by Michelle Feinstein, Vice President of Global Wealth Management Solutions and Strategy at Salesforce. They talk about how to balance the conversation between technology and strategy, how to gain trust as a brand, and why teaching customers how to use tools is more important than creating new ones. All of this and more on the Rev Tech Revolution podcast.

Betsy Peters (00:39): Well, hello everybody and welcome, Michelle. We are just so thrilled to have you here today. Thank you so much for taking a little bit of time to join the Rev Tech Revolution.

Michelle Feinstein (00:49): Oh, I’m super excited. Thank you for inviting me to be a speaker here today with you.

Betsy Peters (00:53): It is our pleasure. Well, I would love to get right into it because I have so many questions for you. But would love to start with just having you give a little bit of background. You’ve had a really interesting career at this intersection of technology and financial services. So tell us a bit about where you started and how you got your current role at Salesforce.

Michelle Feinstein (01:14): So right out of college, and I love telling this story because people are just amazed at how long I stayed there, but I stayed at BNY Mellon for about 25 years, and I held a variety of different leadership roles. They’re always on the technology side of the business. So what’s interesting is, by accident, I started in discount brokerage back in the early ’90s, and what I love is that I was able to step into the shoes of lots of different personas. So back then, I was actually a customer service rep on the phones using the internet and doing internet trading when it was very cutting edge. Over time, I ended up managing teams within the service departments of that discount brokerage firm, and it was called PC Financial Network. From there, I slowly evolved into product management. So this technology concept started to really gain traction with wealth management firms in the 2000’s.

And many of them were trying to build client websites, advisor portals on top of the clearing firm chassis. And so as a product manager, we would customize those experiences for banks, for financial services firms, soup to nuts. So that was a really fun decade. And then after that, towards the last decade of my career at Pershing, I sold technology as part of the Allbridge Corporation for a number of years and also ran consulting and client engagement. Now, when I transitioned, many people are like, “What was that like?” So first and foremost, it’s been about 15 months. So I transitioned during the pandemic and was onboarded to Salesforce fully remote. And I have to say, super impressed with that experience. It really was seamless, and they brought me into their culture and just it felt very natural even though I wasn’t in person. I mean just very welcoming, flexible. And so at Salesforce, what I’m doing today is I run strategy for wealth and asset management on the product side of the organization. So I’m helping their developers understand what’s going to be compelling for asset management firms and wealth management firms when it comes to using Salesforce, specifically financial services cloud.

Betsy Peters (03:20): And so you’re using a lot, obviously, of the 25 years of history that you had in the role that you’re kind of bridging to Salesforce. How do you stay connected as this bridge? So how do you bring the outside into Salesforce?

Michelle Feinstein (03:36): Yeah, so a couple different ways. I mean, number one, in my normal day to day, I’m working very closely with the distribution teams, the customer success teams, the marketing teams. So I’m always involved getting in front of prospects and clients, doing strategic meetings, listening to what their priorities are, their business goals, and then aligning that to the Salesforce value proposition. But the other thing that I make sure I prioritize is I’m always going out into the marketplace, giving my time to different advisory boards or round tables. You might, if you looked at my LinkedIn, you would see I was recently at the SME Asset Management Forum two weeks ago in Tennessee, and I was also just at the Beacon Strategies round table. And in both cases, they had about 40 to 50 firms around the table in the SME Forum, mostly asset management. But it’s a great environment because it’s a very intimate kind of conversation to hear what are their challenges, how are they prioritizing technology investments, who are they choosing? Why or why not? And I find those super valuable to then, one, validate our strategy and also understand what can we do to bring more value to the market.

Betsy Peters (04:48): Yeah, that’s fascinating. And I was following your LinkedIn and curious to know in those two meetings you just had, what’s the balance of conversation between technology and strategy and maybe even talent? How do those things tend to manifest in those conversations?

Michelle Feinstein (05:05): So it was interesting. Both the ways they were structured for the SME Forum, you had a mix of C level executives that were doing the typical presentation, but being very transparent about how they’re changing the way they set strategy, the different folks within their organizations that they’re bringing and giving a seat at the table. So they’re basically saying, in order to really successfully create a plan, you have to bring business technology, the user personas that you’re trying to develop a solution for, marketing, sales enablement, all at the table in the beginning. And everyone has to weigh in on what are the business challenges we’re solving, what are the business outcomes we’re trying to achieve? Do we want to build by or partner? Why? And then who are we targeting to select? So in both cases I saw that, but I would tell you that the conversation definitely did turn to, oh my goodness, we just realized data is a big area we have to focus on, but we don’t have data architects on staff or integration strategies is a big area, but we haven’t really built our bench with API expertise. And so there was a lot of conversation around what is the talent we have? How do we upskill it? What’s the talent that we need? Where do we get it?

Betsy Peters (06:21): Yeah, that’s fascinating. And it almost sounds like senior management at the highest level is becoming more like product management. Is that just me who’s sounding like that?

Michelle Feinstein (06:32): No, I’m going to tell you just based on these two weeks where I spent time with all these senior executives, they’re definitely much more hands on with the technology than they were 10 years ago. So multiple times I heard different C-level executives that sit over managing either all of product or on the business side, managing, whether it’s asset management or advisory services, they’re like, “Yeah, I want Salesforce, for example, installed on my desktop.” And they’re hands on. They want to know how it works inside and out, because there’s so much value that can get out of the platform, but they can’t stay at 30,000 feet to understand it.

Betsy Peters (07:10): Yeah, absolutely. Cycling back just a little bit about your role. Help us get a little bit of context about what your objectives are and what you are trying to accomplish in this bridge role.

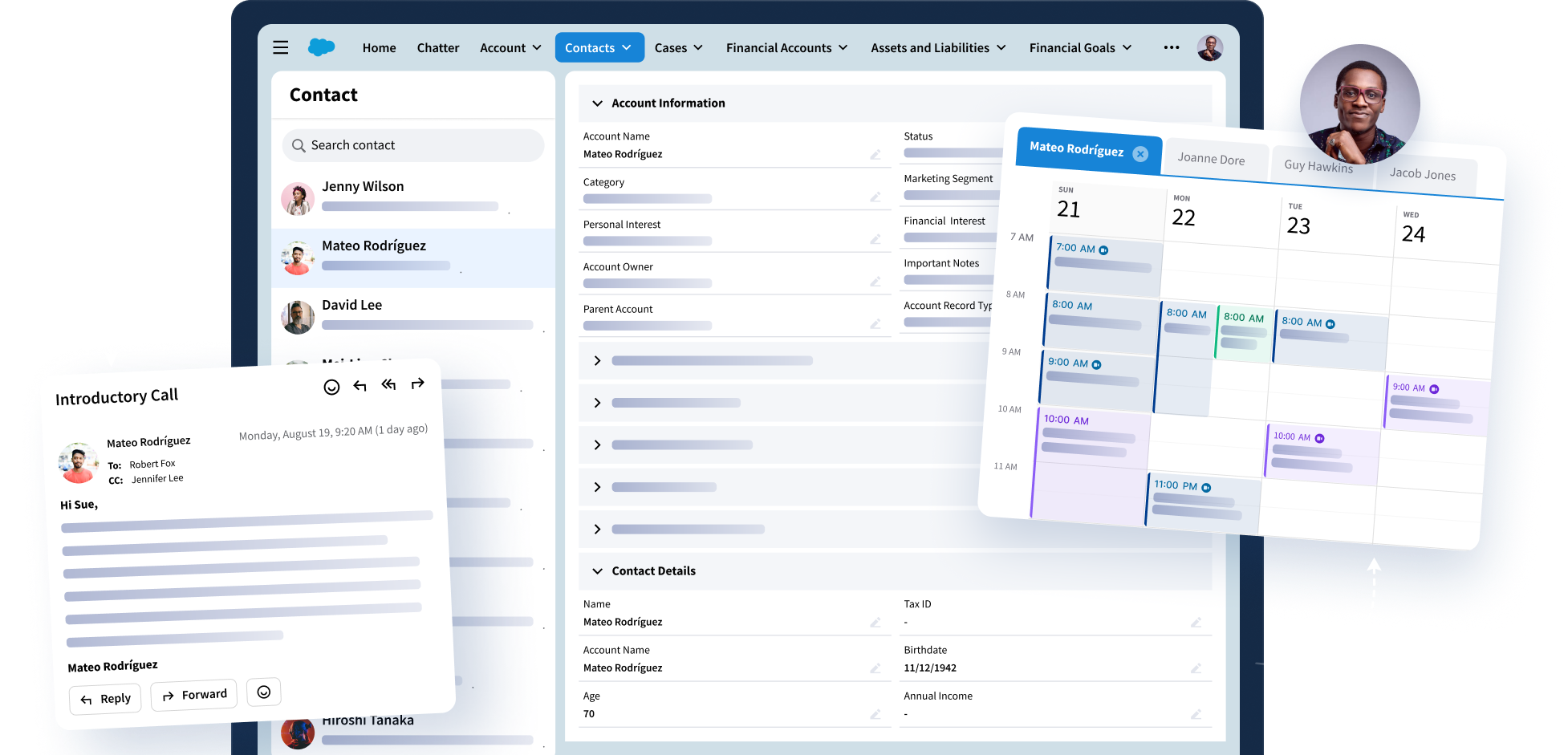

Michelle Feinstein (07:21): So my role is pretty unique where I sit in the organization. Number one, I get the opportunity to spend quite a bit of time with partners that want to innovate on the Salesforce platform, solution integrators, the distribution team, the marketing team, and the product team. And so collectively, we are all deciding, we’re listening to our clients and the marketplace, we’re studying the marketplace, but then we’re kind of getting together and saying, all right, what are the top priorities for the next 12 to 15 months that this product set needs to focus on to accelerate time to value for wealth and asset management firms? So my day to day is, right now, I’m working with some partners that want to build apps, for instance, on top of financial services cloud. Ones that recently did this would be Schwab, Fidelity, for instance. They were in the press and just launched their apps.

To give you some color, what these firms are trying to do is they’re basically saying, “Hey, we have advisors using,” I’ll use Fidelity as the example, “the Fidelity Wealthscape platform, but they also use Salesforce. And so they need an easy path to share data, to sync data, and to navigate between these two platforms.” So we do a lot of those conversations with different partners in the marketplace. The other thing that we do, or I do in the role, is we try to really prioritize voice of the clients. So we will make sure that we do strategy meetings. You’ll often see Salesforce hosting events like the New York World Tour or Dreamforce. There are a lot of customer connections and meetings that happen at those events. And it’s our opportunity to educate clients and say, “Hey, you may not realize, but Financial Services Cloud has really grown since the last time you’ve looked at it. We just recently released all this innovation.”

And so it starts to spur the conversation of awareness and then they’re like, “Oh, I should look at that again.” So that’s another angle. I mean, what are we trying to achieve, right? We’re trying to get folks to see that CRM is more than a Rolodex. For many wealth firms, it’s become the heartbeat of their tech stack, and it is accelerating their modernization initiatives. So we have a lot of firms right now that have made Salesforce the single pane of glass for their advisors, assistants, operations, back office compliance. They don’t do it overnight. It’s a journey to get there, but they’re starting to see that they can use Salesforce to solve data consolidation, streamline integration, automate, empower productivity and more.

Betsy Peters (09:52): That’s fascinating. And I was curious, given, again, your history, your long history here, has there been a predictable path that these firms are following in terms of how CRM has evolved? Do they start out in back office stuff, or do they start out in automations or is there it’s just bespoke or idiosyncratic based on the firm?

Michelle Feinstein (10:16): Yeah, there’s usually parallel paths that are occurring at the same time. But what I would say over and over again, the firms that are succeeding, the place that most have begun is with the data problem. So many of them are saying, in order to modernize and transform our experiences, we first have to understand one, who are the personas that have pain, friction, not a great experience? It’s usually the advisor, the end client, and the middle office operations support staff or service associate. The second thing they do is they study the journey and then they say, “All right, what kind of data do we need to enhance this experience?” And what they start to find is that they have some of the data; others, they have pockets of data that live with various third party solutions. None of the systems talk to one another.

And so any number of these personas have a swivel chair, let me reenter data five times type of an experience. And they recognize they have to start there and fix it. And so what they do, many of them were starting to see, will say, “Hey, okay, let’s clean slate this. We need to have a single source of truth across all our lines of business for the data.” The second thing they have to decide is where is that going to be? Will that be in the CRM like Salesforce in a CDP, which is the client database, or does the firm itself want to be the single source of truth and do they have the stats to manage that and the expertise? It can go 50, 50 for the answer to that question. Once they decide, then it’s a cleanup effort, because they start to realize in order to power experiences, it’s only as good as the data that’s feeding that experience.

Is it consistent? Is it accurate? Is it protected? Is it consolidated? And then once they do that cleanup, they can start feeding experiences. So what do they feed? The experiences I’ve seen prioritized are re-engineering advisor onboarding, re-engineering client onboarding, re-engineering the way money comes in and leaves the organization. So money movement type transactions. And then the other is obviously personalizing experiences. So a big focus is here, hey, how do we segment our clients differently? Because once they figure out how they want to segment them, then they can start to personalize products, solutions, and client engagement models.

Betsy Peters (12:46): What I’m trying to connect in my head is the piece you said about picking up a lot of, I guess concern is the word I’ll use, about not having data integration specialists on staff. It seems like with the journey you’ve talked about, that would be one of the first things they’d hire given the importance of data and it coming in from all these different places. How do you help us true those two things up?

Michelle Feinstein (13:12): Yeah. So many firms are challenged with limited budget and resources. We’ve seen many wealth firms do multiple acquisitions, and so they have this talent laying around in pockets of different broker dealers that they now own. So sometimes, they’re not allowed to just go out and go hire a list of very expensive data architects, and they have to work with what they have. Other times, though, they know that they can augment their staff and their intellect if they choose the right strategic partner. And so what I’ve seen is many firms are starting to study partners like their custodians or firms like a Salesforce or even consultants right out there in the marketplace, and they’re saying, “Hey, can you help bridge this gap of knowledge and consult us on the best way to restructure our data strategy and the models that we’re planning to use?” Once they get on their feet at some point, they might then hire some of the talent that they leveraged as consultants or eventually go out and hire somebody to own it; that’s what I’ve observed.

Betsy Peters (14:17): That makes sense. Tell me a little bit about the effect that regulation has on this kind of work you’re talking about, so data operations and how organizations respond.

Michelle Feinstein (14:27): So coming from the wealth management industry, regulation has always impacted and limited a wealth firm’s ability to be nimble and move fast. Because number one, they have to study the new regs that are coming out. And some of these regs are global when it comes to data privacy, data residency. Right now, there are new regulations that have just come out, if you’ve seen in the market for REAs, right? Managing third party vendors and following the data trail, there are new regulations coming out scrutinizing who’s an independent advisor, what defines that, DOL, best interest. So it is a lot for these firms to think about. Many of them, obviously, all of them, have chief compliance officers, risk management officers, but they also need data privacy officers who their full-time job is to understand, especially, the data regulation.

So what happens is they have to build in what’s required, usually points to easy access to the data; that points back to the need to have a clean data leak. That means you also need good reporting and analytics that are easily accessible and transparent to multiple people in your enterprise as just a few examples. If you look at DOL, it also pointed back to technology. Many firms were like, “We’re never going to be able to meet this rule unless we start automating many of our manual processes and pushing out and making things like disclaimers and tracking financial plans and when they’re updated, to prove that we’re adhering to best interest requirements.”

Betsy Peters (16:03): And just something as simple as having different team members be able to see the same calendar invite could trip a wire.

Michelle Feinstein (16:14): So many firms, Betsy, are just dealing with this very, I call it a simple issue. You think it would be solved, but so many of them have grown so fast either through acquisitions that they have multiple lines of business that are global, but they’re all using different CRMs, different homegrown databases, different data repositories, different client masters, and they’re trying to break those down and actually retire some of those things so that they’re all using a consistent tech stack.

Betsy Peters (16:44): Yeah. Well, plus the explosion of new functionality over the last couple years. I read somewhere that there’s like a billion dollars of BC that’s gone into growing the revenue stack in just two years.

Michelle Feinstein (16:53): Yeah, take a look at [inaudible 00:16:55], this is Fintech map; it grows every single month. He almost needs now to move on to two or three pages to show the full picture of what the tech blueprint looks like for any advisor or wealth firm.

Betsy Peters (17:08): I’d be curious to know given your experience, how are organizational structures changing in wealth management to accommodate data driven decision making?

Michelle Feinstein (17:18): So, again, I have the benefit of meeting with lots of different clients across both wealth and asset management. And one of the areas that I’ve started to see, most of them have started to prioritize or already have them on staff chief data officers, chief marketing officers, chief client experience officers, and they all have to play together. They’re all trying to redefine how to modernize, how to automate, how to increase productivity, how to find new growth drivers in segments to pursue. It all points back to the data. So now that you have all these C-level executives with their mandates, what they’re trying to do is say, “Okay, how do we use the data to start to pinpoint, in the case of a chief revenue officer, where’s the growth been? Where do we see attrition? Where do we have opportunities to penetrate a new market that we’ve never pursued before, but maybe our competitors have?” Right?

So that’s really powerful. In the example of the chief marketing officer, we see most of them using the data to figure out how do we personalize experiences for our clients? Well, to begin, they need the data to point to different segments of clients that they have. Many are starting to target niches, like women. What are the needs of the women investors? Who do they want to be matched up to in terms of an advisor or a portfolio manager? What kind of products would be most relevant to them? If you changed the segment to a Gen Z individual, the story would be completely different. So they’re able to use the data in these scenarios to study trends, anomalies and behavior, personality traits, preferences, goals, objectives for their financial planning, and then really start to get very prescriptive in the solutions and the products that they’re offering.

The other thing I’ve seen is some firms have said, oh, because this data challenge has become something that requires a lot of oversight, some firms are actually forming data councils where to make sure there are no silos, every month, they’ll have people from product, technology, business, marketing, sales enablement, having a seat around that table of that data council to make sure that there are no red flags, no issues, no new regs that they have to consider, and aligning on priorities. We can only do so much this year, so what are the most important data driven initiatives that we’re going to tackle?

Betsy Peters (19:40): Yeah, that’s fascinating. So is there the equivalent of a revenue operations function that leads that council? Or is it much more kind of a team sport type of thing?

Michelle Feinstein (19:53): Yes. If you look at… That’s the RevsOps topic is just another way, it’s another word, to describe what these data councils are trying to achieve. If you do some research on RevOps, and actually Salesforce produced some research back in 2021, if you Google it, you’ll find it, where it basically is just what I described. It’s like you cannot work in a silo, so you need people that have the responsibility of managing growth and revenue for the firm. You need people at the table that are responsible for managing and governing the data flow. You need people that are responsible for empowering and training the teams, the advisors, and providing the right data sets to those personas as well as operations. So you need lots of different people to be at the table, and they have to work in harmony together towards the same business outcomes, goals, and objectives. That’s RevOps.

Betsy Peters (20:42): Yeah, for sure. There’s many, many stakeholders, of course. I guess my question is a little bit more along the lines of the who’s the real champion who drives the projects once the council has decided on prioritization? Is it an IT person still? Or is there more of an operations function, like a true director of RevOps, VP of RevOps, or what are you seeing there? Who supports the council to get the job done?

Michelle Feinstein (21:06): From what our research has shown, it’s not one sided. So typically, it’s always lived on the technology side, but we’re starting to see more of a hybrid model where you have, yes, it lives in tech, but they have some kind of dotted line counterpart on the business and rev side that’s helping them to manage this responsibility.

Betsy Peters (21:26): That’s great. Let me shift gears a little bit to the outcomes of really good data stewardship. So in your recent state of the connected customer report, there’s a really heavy emphasis on trust. So how has this movement towards a trust based economy affected tech and talent and wealth management? And what does it take to succeed with this transition?

Michelle Feinstein (21:49): So the report that Salesforce issued, it’s the fifth edition of the connected customer report, definitely worth the read. So what they do is they go out and they survey thousands of clients, but also thousands of wealth firms, and they try to get both perspectives in there. And what it revealed is one of the number one priorities for clients is doing business with a trusted brand. Client loyalty and trusted brand are top of the list. But how do you achieve that as a wealth management firm? Well, number one, you have to really walk the talk, so you can’t just say you’re a trusted brand. In order to do that, it starts to point back to number one, the interaction with the client has to feel personal. They have to feel you know them, that you’re studied kind of the needs, the goals, the objectives, the experiences that they want to have, but the data also has to be accurate.

The reporting that you’re doing with that client has to be accurate. And a big part of trust is service. So if we think about ourselves, if we’re out there as a consumer and we have an interaction with a firm, a simple thing like not being responsive or not getting back to me and solving my issue within an acceptable timeframe starts to break my trust. And the study reveals that clients will walk away from a bad experience more quickly than ever since the pandemic, because the bar has been raised. And wealth management firms are being compared to the best consumer experiences out there.

So going back to the service experience, it needs to be quick, fast, personal, and you need to give me a channel of choice. So maybe I want a bot to begin, or maybe I want human interaction. So not forcing an individual or a team into a set model is very important when it talks about trust. The other is I’ve seen some firms when they talk about being a trusted brand, also it’s about proving that your company cares about what’s happening in the environment, what’s happening in the economy, what’s happening in the political landscape. And so firms are trying to communicate their efforts to improve the employee experience, to have a diversified staff, to be a contributor to reducing carbon emissions, to supporting diversity and inclusion efforts. That’s all part of the trust too, because that says you’re doing something that’s very human and meaningful to the world.

Betsy Peters (24:15): Yeah. And I wanted to dig in a little bit more to that employee experience piece. So what’s your experience when the customer facing end users or the go to market teams or the advisors, pick whichever group you’re talking about here, what are the implications when they don’t trust the data that’s in the systems in the CRM? Is there higher turnover? Did the research suggest anything like that? And kind of friction filled experiences, like you said, swivel chairing, what are the impacts to employee retention even?

Michelle Feinstein (24:46): So it’s a huge challenge for wealth firms, because if you look in our industry, so many of us will say, I worked at my firm for 30 years, I’ve been here 20 years. So they get stuck in very comfortable processing methodologies or client engagement methodologies. It takes a lot to convince an advisor or someone in the home office to change the way they’ve been doing things all these years. And so technology can be scary. And many of these firms, when it comes to training and getting folks to adopt these new experiences that they’ve just invested in, I would say at least 50% of wealth firms are still only seeing 20 to 30% of adoption of these new client onboarding or asset movement or mobile capabilities that they roll out. The second is, yes, many advisors now are starting to see the next gen of advisors coming into wealth.

They’ve all grown up with technology; they don’t know how to communicate any other way. So when they come in, they have high expectations that they’re not going to be doing a lot of manual processing. They’re going to be able to engage with their client anytime, anywhere, and share data easily. And so if they cannot, they will quickly leave and hop to the next wealth firm that is more modernized. And so that’s why you see many wealth firms prioritizing things like onboarding an advisor to their shop because that’s like a first date. If they get that wrong, the advisor won’t stay. We’ve seen a lot of asset management and wealth management firms also starting to look at, look, to retain good talent, their employee base, they need to show them that, hey, we’re going to give you tools, whether it be slack, video capabilities, new ways of collaborating in an efficient manner, especially because we’ve all now been put into this hybrid work model.

So it’s about arming the employees with the right tools so they can collaborate quickly, easily, feel good about it, share data easily, because many are not ever going to come back into the office full time. And so firms are starting to see a lot of increased productivity results that pays them back for the investments that they’re making. But advisor retention, advisor upskilling, the other thing I would hit on is it’s not just about giving them the tools, it’s teaching them how to use them. For advisors, showing up on video as opposed to in person selling their value prop, pushing their brands out on social media, that is new territory, especially for those advisors that are more mature in their careers. And some of them don’t want to admit that they might need some guidance. And so firms can be proactive with their practice management, bringing experts in. I’ve heard of some firms bringing in people that were newscasters or on TV to help these advisors really show up and look professional and be engaging.

Betsy Peters (27:38): Yeah. Interesting. So let’s fast forward five years. Given today’s focus on data, how it’s used, what it tells us, where do you think wealth and asset management firms are going with humans, with technology? What’s going to be really important in the near future?

Michelle Feinstein (27:58): So many firms are right now in the throws of trying to evolve from a wealth management 1.0 model to a wealth management 3.0 model. And there is a lot that’s involved in doing that, because it affects people, process, technology, culture, the way you do development, becoming more nimble and agile, many different things. And so in order to get to Wealth 3.0, most firms between now and the next few years are focused on replatforming their technology, leveraging more strategic partners to accelerate their innovation, reducing complexity and their technology architecture. So some firms have not changed out their servers and their technology for 10 years, and they’re finding that that tech does now not work with some of the new FinTech capabilities with AI, with public cloud capabilities and more. And so that foundational change has to be made before they can start to take advantage of some of the sexier technology.

So we see a lot of firms between now and the next five years saying we have to scale, not add people to our staffs. So we have to leverage strong tech platforms to accelerate automation, refine business process management, workflow, and develop in a no code, low code type of way, because everybody can’t be a developer. So they’re actually expecting some of the people that are in their shop to have some technical skill to bring some of these experiences to life. Right? Yeah. The second thing I would say is we see, again, between now and the next few years, a big focus on changing the way that they attract the next gen advisor and keep them the next gen client and serve them. Investments are doubling down for middle office and back office capabilities and wealth. So it doesn’t sound sexy, but again, many of them focused mostly on the front office before the pandemic and during it.

And now that the dust is settled, they’re realizing that some of their middle office, and definitely their back office, is still very manual, and there’s a lot of redundant data entry; it’s paper intensive, and so they’re going business process by business process. Some firms I’ve met with have hired consultants and identified upwards of 30 to 40 business processes to re-engineer. You can’t do that in a given year. That will take multiple years. So it’s a long-winded way of answering your question, but many firms are on this journey that will take them at least three to four years to get there. Now, what’s next? Well, after that, even though these terms aren’t new, like artificial intelligence, predictive analytics, robotics, natural language processing, the momentum is accelerating, because as firms start to finish their foundational tech, they’re now starting to see, we’re all starting to see, Fintech’s come out with some really interesting solutions, digital assistance, robotics to replace human processing, that is really going to change the game for wealth, and we’ll put them more on par with some of the consumer experiences that already leverage those capabilities really well.

Betsy Peters (31:08): Yeah, I like that frame of trying to leapfrog from Wealth 1.0 to 3.0 in five years. That’s a huge challenge.

Michelle Feinstein (31:17): Oh, yeah. Just one other point on that. To go from 1.0 to 3.0, it’s about expanding customer focus, expanding the types of investors and segments, going back to that modern segmentation that you’re prioritizing, being digitally led, human led, and hybrid led in how you deliver service and client engagement. And then your architecture has to be very open. Open architecture, data has to flow easily across multiple providers

Betsy Peters (31:45): And be kind of unified or aggregated so you can look at it under these various lenses, not just one way you’re going to want to look at. It’s multifaceted.

Michelle Feinstein (31:54): And know your client, know them deeply. That points to a client master. Yeah.

Betsy Peters (32:00): Michelle, you have been so generous to give so much of your time to us, and it’s been a fascinating conversation. I have one more question if you have the time. What is something everyone in your industry should stop or start doing?

Michelle Feinstein (32:13): Oh, I have so many that I could say. I would say, number one, stop taking forever to make decisions and try to be more concise and timely and making decisions to impact change. Number two would be stop customizing every experience that you choose to re-engineer and lean more into configuring experiences. So make sure that whether you’re building it or you’re using a third party, that those experiences can be configured with a flip of a switch through entitlements. And then my last point would be inclusive. So change the way that you’re committing to change your firm. Bring in different stakeholders at the beginning of projects, and keep them on those initiatives all the way through until you deliver those experiences, and you’ll see, I think, better success.

Betsy Peters (33:05): Wonderful. I’m going to give one little plug to a group that we both belong to and ask a question about women. So the two of us are both members of Chief, and I’m curious to know what all of these changes you see coming in the industry might… How might women benefit in terms of getting greater leadership roles in wealth management because of these changes?

Michelle Feinstein (33:28): Yeah. I would say number one, all the firms, whether they’re technology or wealth management firms, have really accelerated their prioritization of getting more women into the C-suite and into middle management. And so for example, most of the women that have joined Chief are being sponsored by their companies to be part of that organization. So to me, that sends a message of we’re investing in our women. At Chief, we get exposed to not only great people that we get to meet and network with, but training on how to brush up on your leadership skills or learn how to become a board member. And we know out in the marketplace, that’s a huge initiative. How do we get more women on boards? A company like Chief says, “Hey, we’re going to teach you how to do that and expose you to women that actually have succeeded and made it onto the boards.”

But it’s not just about getting on there. What do you do when you’re in? So I think there’s a wealth of opportunity. The other area is just, you heard us talk about the talent needs. Plenty of new roles are emerging for women to step up and raise their hand. And if you look at, many women are not waiting to be tapped on the shoulder, they’re stepping out of their comfort zone, taking stretch assignments and saying, “Put me in this role. It’s totally different than what I’ve done before, but give me a chance.” And they’re succeeding, and they’re growing their skill sets.

Betsy Peters (34:46): Well, you are a fabulous example of that. Just moving from one thing to another throughout your career, and thank you so much for the mentorship during this time period, and we were thrilled to have you, Michelle. Thanks again for all your time.

Speaker 1 (35:00): Thank you for tuning in to the Rev-Tech Revolution podcast. If you enjoyed this episode, please don’t forget to rate, review, and share this with colleagues who would benefit from it. If you would like to learn more about how Riva can help you improve your customer data operations, check out rivaengine.com.