Most enterprises invest in CRM to establish a shared repository for the vital—and valuable—customer data gathered in the ordinary course of business. But as workflows specialize and applications in the communications and revenue stack proliferate, CRM is falling short of its potential. This shortcoming occurs because the data from these applications rarely makes it into CRM in a timely, complete, and accurate flow.

For years, CRM vendors have been trying to get customer-facing teams to “adopt” alternate workflows—which either meant a mandate to enter data into two systems or to use a CRM feature for a task better suited to a feature in a platform like Outlook. Either approach creates inevitable gaps in the Customer 360 goal—leaving IT and operations teams in a difficult spot. They’ve invested in CRM as a critical engine for digital transformation—but it’s not yielding the expected results.

Now, teams are beginning to recognize that data is its own layer of the technology stack—and that an investment in data operations is easily justified by the economic impacts it regularly creates.

Customer Data Operations to the rescue

As enterprises recognize data as a layer of the tech stack, it becomes easier to diagnose existing issues interfering with data access and use—and to develop effective solutions. While you could carry on with one of the compromise solutions highlighted above, they put CRM adoption, productivity, data quality, data trust, revenue growth, and customer and end-user retention at risk. Given those stakes, the idea of investing in a data operations solution capable of unifying, governing, and distributing customer 360 to your go-to-market teams quickly gains appeal.

But how do you convince your bankers that this choice is less a choice than an inevitable need? Your enterprise’s decision-makers will likely feel the frustration of a CRM investment that isn’t meeting expectations. As a result, you’ll be compelled to make the case for data operations by outlining its transformative potential—and quantifying its potential impact on the enterprise.

6 points to make make the case for a customer data operations investment

In an effort to arm you with the business case you’ll need to persuade decision-makers—particularly CFOs—that customer data operations are a smart investment, we’ve developed a short list to drive the point home. Here’s a quick overview of what customer data ops can do:

1. Boost team productivity

As discussed above, many enterprises turn to manual data transcription to transfer communications data captured in email, calendars, and contacts to their CRM. In addition to the customer history perils that come with transcription errors, omissions, and duplications, this practice consumes lots of end-user time that would be better spent on other tasks—including customer engagement.

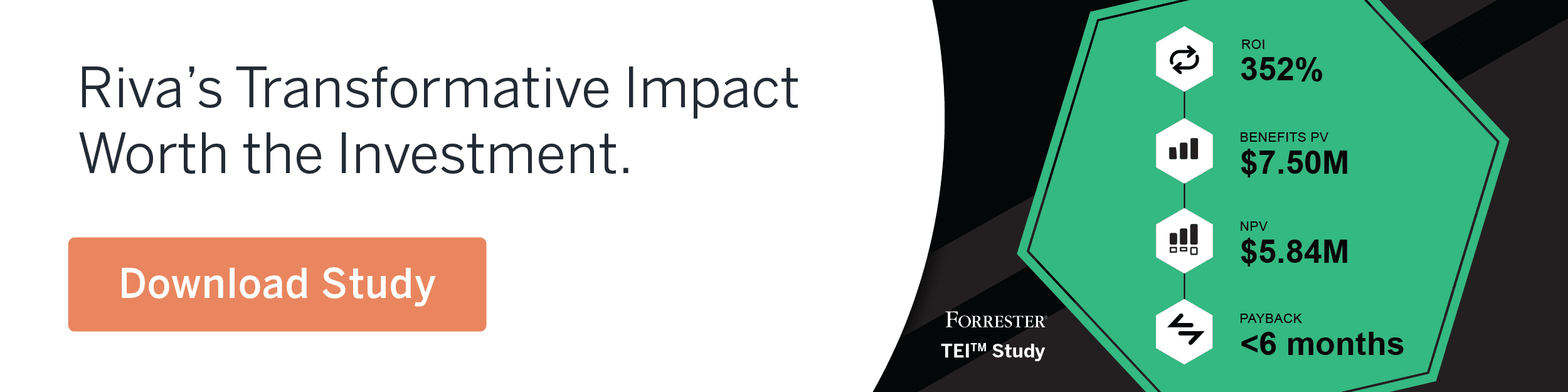

In business, time really is money. And when an enterprise deploys a proven customer data ops solution, it can reclaim and redirect time previously spent on data transcription. For example, in a commissioned study conducted by Forrester Consulting on behalf of Riva, a composite organization (based on interviews with four current Riva customers)—demonstrated annual savings of 41,400 hours per year on a 750-seat deployment—and a $3.4M productivity-driven profit increase over three years.

2. Support and inform efforts to personalize customer service

One of the more profound benefits of customer data operations is its potential to provide end-users with a single source of comprehensive, trustworthy customer history data. As a result, end-users can personalize customer engagements—a particularly high-priority goal for FINS seeking to improve customer experience and retention.

In industries where customer expectations for personalized service continue to grow, the benefits of true customer 360 are clear. Customer-facing teams are better positioned to act less as salespeople and more as valued advisors whose recommendations specifically address their current needs—and offer guidance to anticipate and plan for the future.

From the enterprise perspective, customer data operations serve as a powerful tool to cross-sell and upsell to existing customers—helping to boost customer retention, grow lifetime customer value, and enhance revenue.

3. Improve data observability, resolve data quality issues—and bolster data trust

Data quality isn’t simply a desired outcome—It’s a process. Customer data operations solutions like Riva provide enterprises with the tools to monitor revenue and communications data throughout their lifecycle and pinpoint data quality problems before they compromise data trust.

Riva’s sophisticated admin capabilities allow administrators and managers to monitor end-user activity and data quality at any time—and intervene when issues are exposed. And for clients that employ Riva Insight, end-users can see and edit customer data as they use it—providing essential updates that are automatically shared to CRM. As a result, end-users consistently work with trustworthy data—giving them the power to build and maintain strong customer relationships.

4. Reduce (costly) scheduling errors

For end-users in nearly any enterprise, calendar accuracy plays an essential role in customer satisfaction and revenue growth. In the same Forrester TEI study of Riva, the composite organization demonstrated $3.7M in time savings through automated calendar sync alone.

To better understand why calendar sync is so important, it’s helpful to imagine the all-too-common alternative where CRM and communication platforms don’t automatically sync: appointments are missed, participants are overlooked or double-booked, and both end-users and customers are frustrated. With Riva’s automated calendar sync, end-users enter appointment data once and automatically shared—giving all key parties a single source to ensure details are accurate and appointments are kept.

5. Diminish the threat of technical debt

When existing processes are failing, enterprises are wise to view data as the canary in the coal mine. Why? Because compromised data quality often traces back to outdated or ill-performing processes or applications. In many cases, the gaps in data quality predict the need for technology upgrades that, when overlooked, can allow an organization’s tech debt to grow.

6. Pays for itself—quickly

In the commissioned Forrester Consulting TEI study, the composite organization demonstrated payback of the Riva customer data operations investment in fewer than six months. And while it’s common for technology providers to promise speedy ROI, a six-month payback—and a 352% three-year ROI—is exceptional.

But on close analysis, those results make sense. Through measurable impacts like the elimination of manual data transcription and corresponding improvements to end-user productivity, Riva customer data operations bring game-changing impacts that translate to efficiency improvements and revenue gains.

Summing up

From a CFO’s perspective, investment decisions aren’t frivolous. Expenditures require justification—whether to streamline business operations, maintain competitive advantage, or drive revenue. Given that prerogative, making the case for investment in customer data operations is imperative. Given the importance of high-quality data, sustainable worker productivity, customer lifetime value, and revenue growth, it’s an easy case to make—because customer data operations are worth the investment.