If you’ve been looking for the right opportunity to explore the concept of digital banking transformation, you’re in luck: we’re about to do a relatively deep dive. If you’re already up to speed, we’ll do our best to enrich your understanding of the financial services industry’s rapid and enthusiastic embrace of digital transformation technologies and strategies.

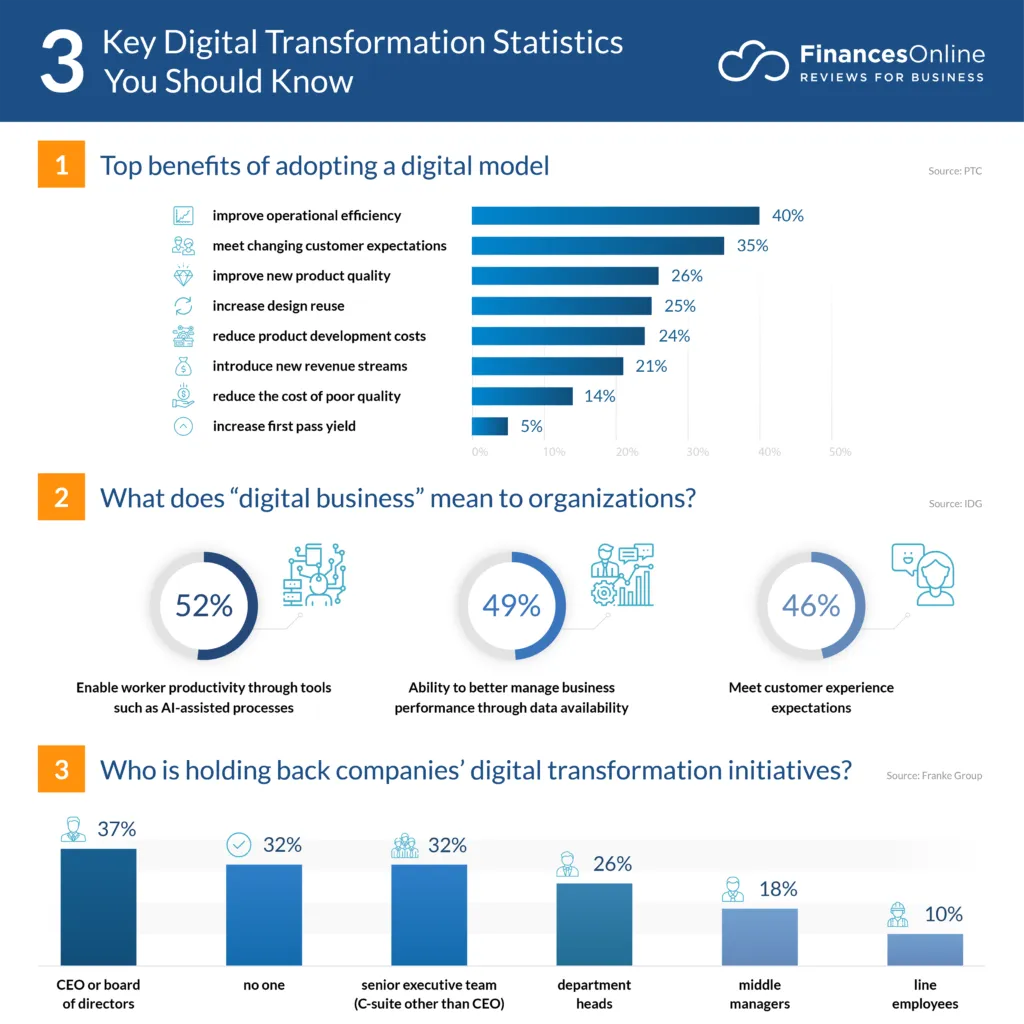

Digital transformation is a profound shift in the way the entire financial industry (and a lot of others) does business. It affects FinServ enterprises at nearly every level — from operations and finance through sales and marketing — and delivers its most powerful impacts in the areas of customer activity capture and sales engagement by:

- Unifying customer data

- Boosting advisor productivity

- Enhancing customer experience

- Improving security and compliance

- Outmaneuvering digital-savvy competition

In banking, digital transformation is not only about enhancing operations but ensuring rigorous risk management, regulatory adherence, and customer trust. For financial institutions, this journey involves embracing secure and compliant technologies to meet stringent industry standards and deliver on evolving customer expectations.

But knowing what digital transformation does is just the first step to acknowledging its power, accepting its importance, and above all else, actively working to embrace and implement digital banking solutions throughout your organization.

“The acceleration of digital transformation is one of those things that just can’t be stopped,”

Viren Patel, Industry Strategist for Financial Services and Insurance at Workday (cited in Lous Thompsett, “Digital Banking Transformation: Accelerating into 2024”, Fintech Magazine, 5 January 2024)

Given the accelerating pace of change in the banking industry, it’s not a question of if banking technology trends will affect how your bank does business. It’s merely a question of whether you’ll take the lead — or find your future self-doubling down later in a desperate effort to catch up to your competition.

So, to help you chart your course through digital transformation, this article will cover a lot of fundamental ground, including key drivers, benefits, challenges, case studies, and future trends.

What is digital transformation in banking?

Digital transformation in banking industry is the enterprise-wide adoption of technologies and strategies to unify data, leverage advanced analytics, enhance security and compliance — and embrace AI and automation in both online and mobile platforms to boost advisor productivity, personalize customer experience, and gain competitive advantage.

“Digital banking platforms allow banks to offer a host of digital financial products across multiple channels to meet customers wherever they are.”

Washija Kazim, “The Rise of Digital Transformation in Banking: Why it Matters”, G2, 26 May 2023

The financial industry has been slower than others to retire legacy systems and invest in innovation, which is caused by complexity involved in banking, such as balancing accounts, math, emotions, markets, and regulations etc.

How does digital banking transformation differ from traditional banking?

The answer lies less in what banks do for customers than how they do it. Instead of relying on manual data entry-intensive legacy systems that silo business units and the data they gather and use, digital transformation focuses on:

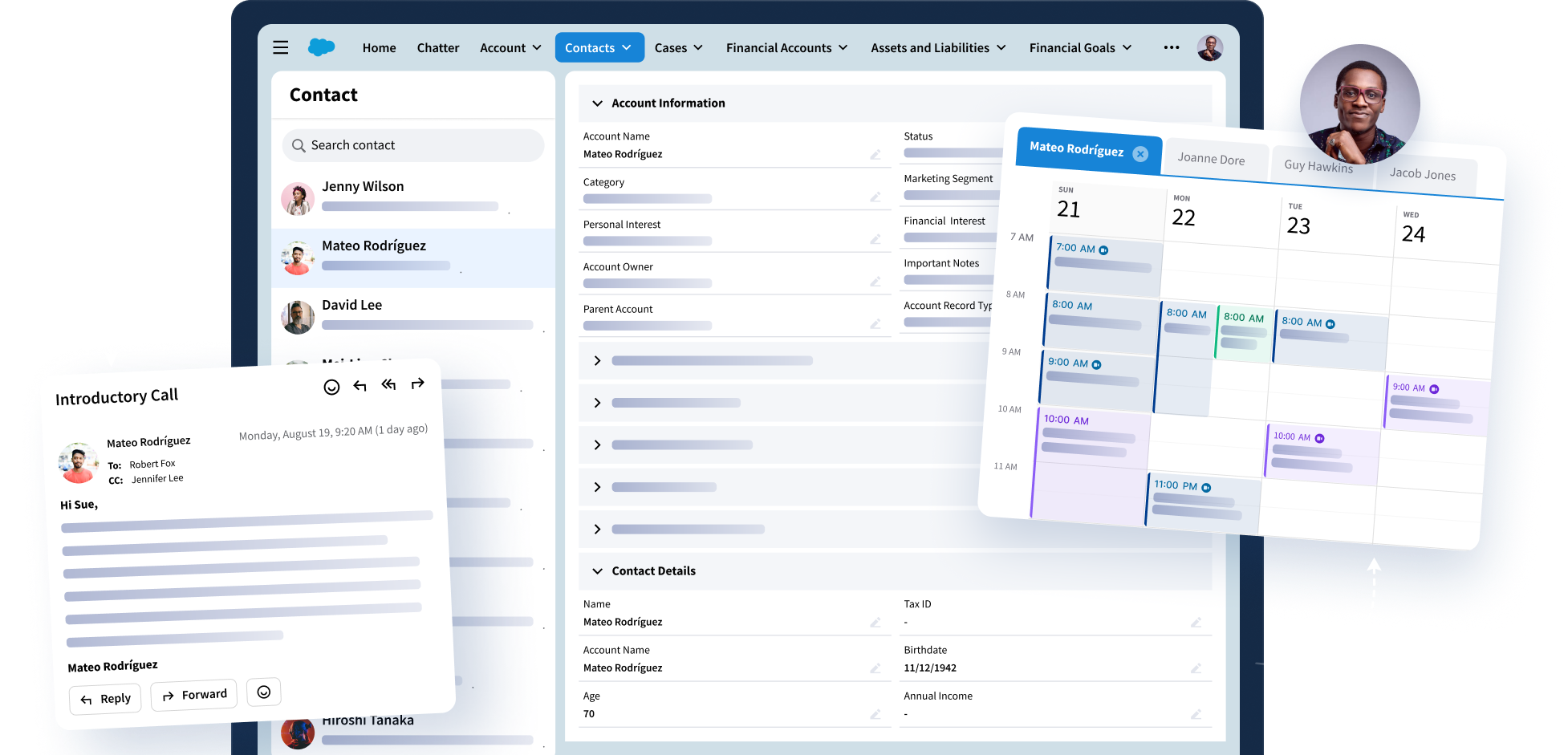

- Achieving customer 360 with CRM as the single source of truth

- Implementing integrated, enterprise-wide customer activity capture and engagement solutions native to both desktop and mobile platforms

- Leveraging AI to automate data capture, boost data quality, and ensure security and compliance

- Amplifying advisor productivity with AI-supported tools that personalize and automate selected customer communications.

Main aspects of bank digital transformation

In effect, digital banking transformation strategy represents nothing less than the wholesale integration of technology into every aspect of banking operations. It’s a tall order to fill, and given the banking industry’s justified aversion to risk, it’s no wonder digital transformation got off to a slow start.

But that’s changing fast, as the industry recognizes the benefits of fintech in banking — at almost every level of the enterprise:

Technology modernization

Like other industries, banks have struggled with the gradual, enterprise-wide buildup of technologies that don’t play well with each other — resulting in overwhelming interdepartmental siloing and increased burdens on IT departments.

Digital transformation allows banks to resolve that tech debt conundrum with enterprise-wide technologies and strategies that cross applications and serve customers, advisors, and business objectives.

Enhanced customer journeys

Working with unified data and single-source-of-truth CRM, bank advisors can see every aspect of each customer’s journey and leverage powerful analytics and sales engagement technologies to help predict and support future trends.

Cross-industry alignment

Banking customers come in all shapes and sizes — from individuals to corporations.

By embracing digital transformation, banks are better positioned to provide secure, efficient experiences for all customers — including early adopters whose systems are designed to seamlessly engage with those of their preferred service providers.

Key drivers of digital transformation

“There is a need to go beyond the “talk” of digital transformation. As consumer expectations changed, competition increased. Thus, the need to adapt quickly became the norm. Digital transformation has become a matter of survival.”

Jim Marous, “7 Essentials of Digital Banking Transformation Success“, The Financial Brand, 2024

Before financial institutions go all-in on the significant financial and resource investment required of digital transformation, it’s important to understand the key drivers that make it worthwhile. Here, for starters, is a short list of the highest-priority reasons to pursue digital transformation:

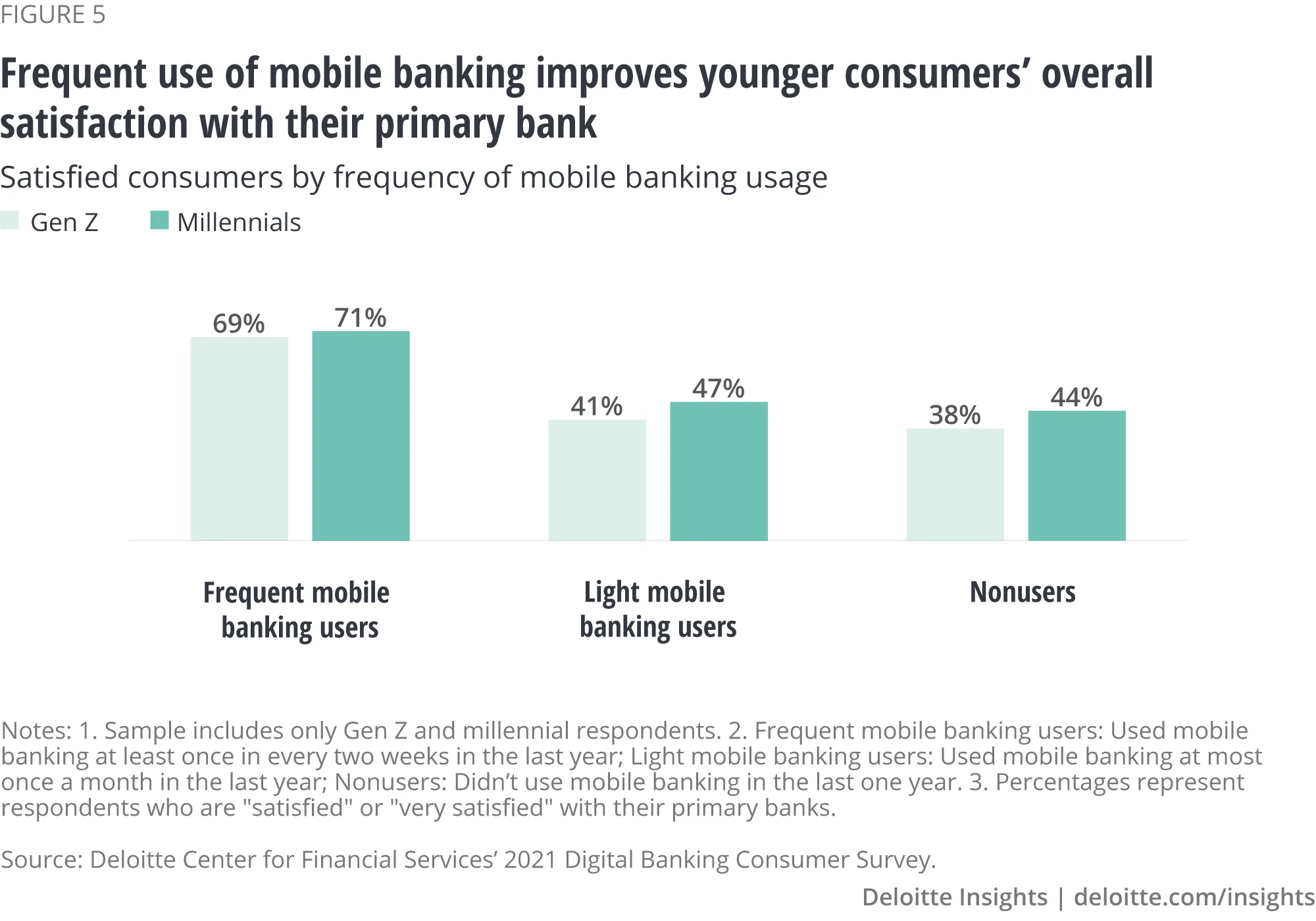

Evolving customer expectations

As technology’s role in everyday life has grown, customers have grown increasingly willing to share their data with the companies they trust. They’ve also come to expect corporations to use that data to improve customer experience. When working with financial institutions, they expect faster, more convenient services that are personalized to suit their unique needs.

Rapidly advancing technology

Emerging technologies are revolutionizing the way banks process and use the customer data they gather in the everyday course of business.

AI technologies have radically improved analytics and the ability to predict trends and customer needs. Blockchain technologies have changed the way money moves — and the very nature of currency itself.

And cloud computing has allowed banks to centralize customer data, making it accessible across the enterprise, significantly increasing the potential to leverage its power to change the entire banking experience.

Changing competitive landscape

As more banks embrace digital transformation, those that don’t pursue new data-enabling technologies risk being left behind. To meet industry and customer demands, banks must develop strategies that integrate AI, blockchain, and cloud computing to remain both relevant and competitive.

Ongoing regulatory changes

Whether banks are regional, national, or global, they’re subject to constantly changing governmental regulations.

By leveraging the AI-enabled technologies of digital transformation, financial institutions can automate efforts to monitor relevant regulatory shifts and ensure that data stewardship practices remain current — eliminating the risk of non-compliance.

Core elements of digital transformation in banking

“Beyond providing the ability to personalize engagement and improve security and privacy, it has been found that organizations that inject big data and analytics into their operations outperform their peers in both productivity and in profitability.”

Jim Marous, “7 Essentials of Digital Banking Transformation Success“, The Financial Brand, 5 October 2020

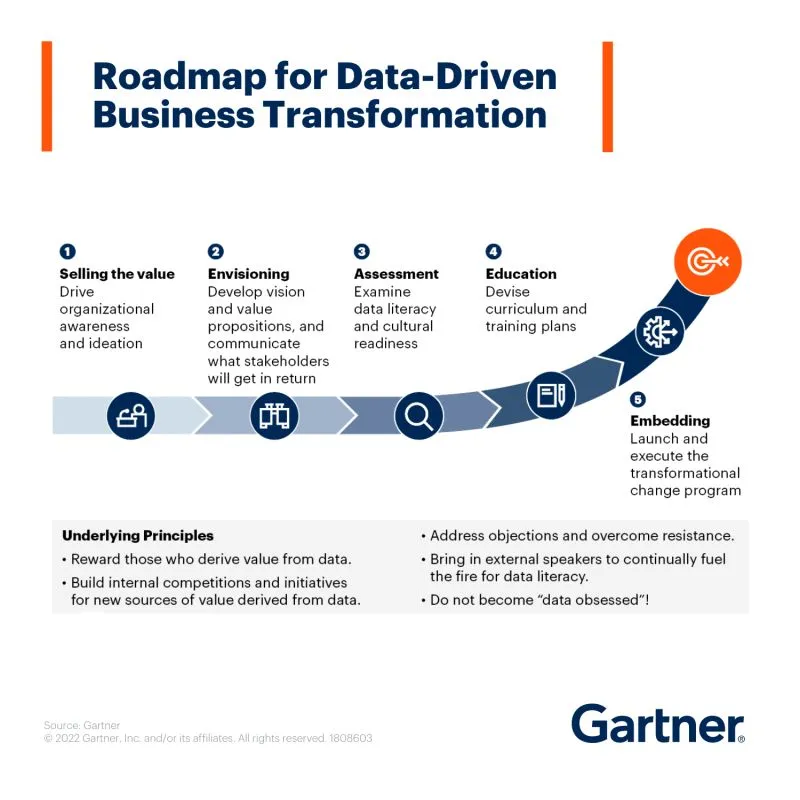

When banks formulate digital transformation strategies, the process involves a range of touchpoints and technologies that cross the entire enterprise. Deliberate planning requires an assessment that considers a range of core digital transformation components.

1. Digital banking platforms

From desktops and mobile devices to smart meters and RFID scanners, there are few places where financial technology doesn’t touch our lives.

Businesses are now able to more closely and accurately track each point of customer engagement and automate transactions behind the scenes.

Customers can then engage with businesses and banks on their own terms—at home, at work, on the go, or in person.

2. Data analytics

As technologies and strategies for unifying and improving customer data quality have improved, so has the accuracy of data analytics. Working with these powerful tools, banks are better able to identify trends and improve predictive accuracy.

This evolution helps banks to inform competitive strategies, and to empower advisors in their efforts to improve customer engagement.

3. Automation and AI

Banks and financial services enterprises are quickly climbing the AI and automation adoption curve. Going forward, that industry-wide transformation will only accelerate as the power of large language model (LLM) data processing and generative AI improve and evolve.

Currently, banks are integrating AI-enhanced technologies to:

- Automate routine tasks like data capture, transcription, improvement, and unification

- Process vast data resources to identify patterns and inform sophisticated predictive analyses capable of informing product and service development, customer needs, and emerging market opportunities

- Leverage generative LLM to produce and distribute targeted, personalized communications to support, educate, and cultivate current and prospective customers.

- Support complex task automation — like campaign cadence creation, execution, and refinement — using AI copilots.

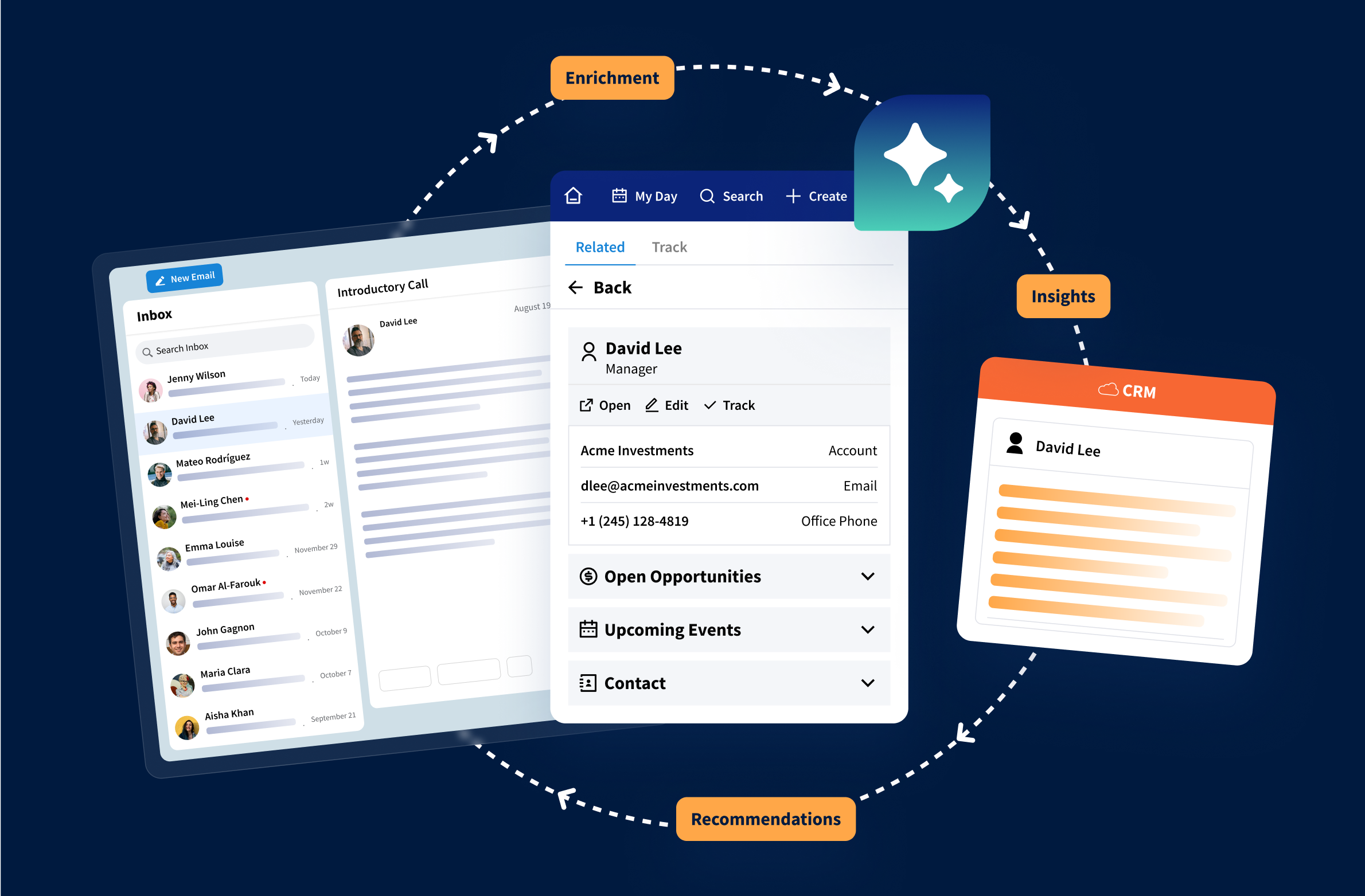

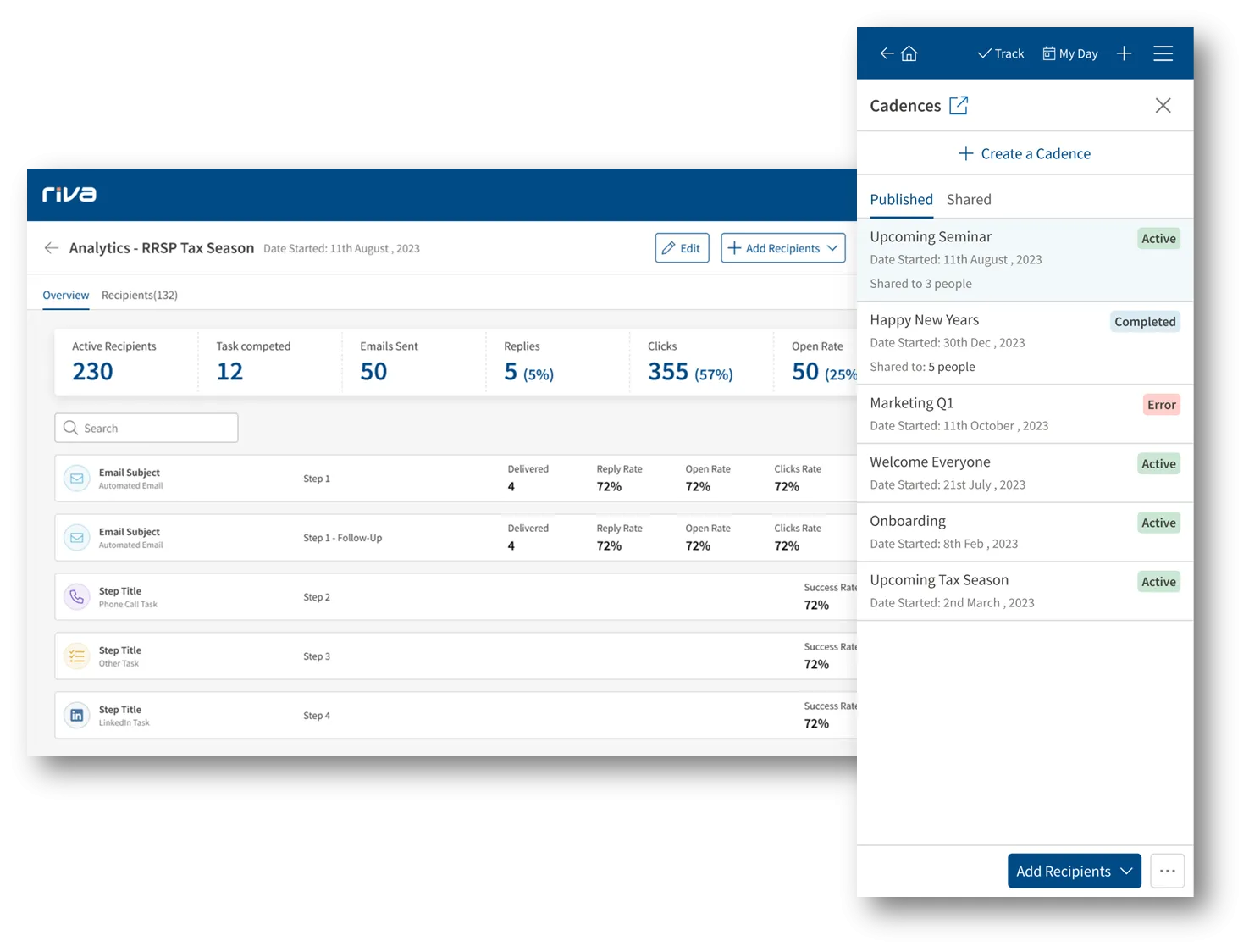

In practical terms, tools solutions like Riva utilize AI to automate the secure, compliant unification of high-quality customer data to support CRM-based customer 360.

Working with that data, sales teams can then automate the development, distribution, and analytics-based refinement of personalized customer communications to support each customer’s journey — while increasing productivity, retention, transactions, and customer lifetime value.

Learn more: Using AI to Revolutionize Customer Experience with Vishnu V Ram

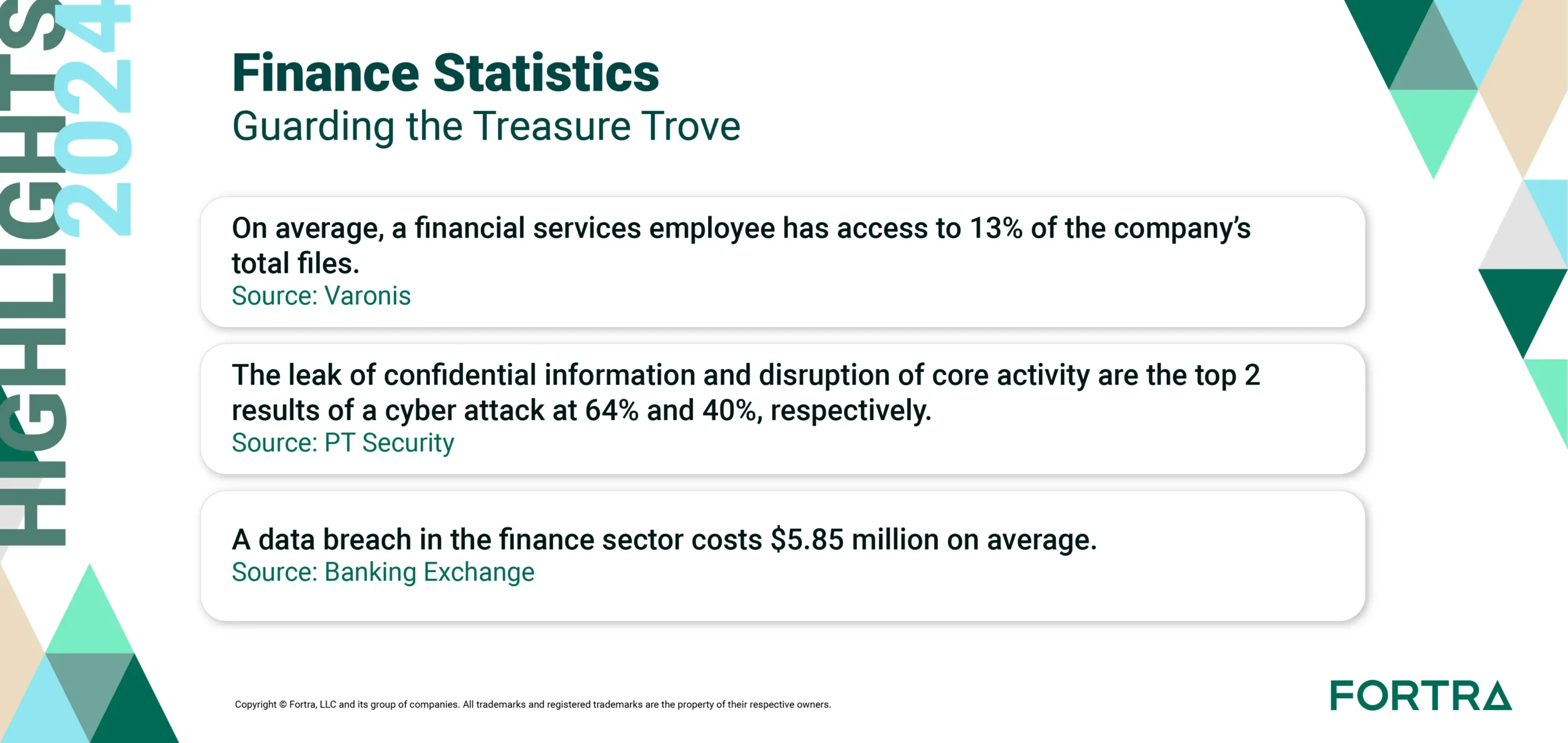

4. Cybersecurity

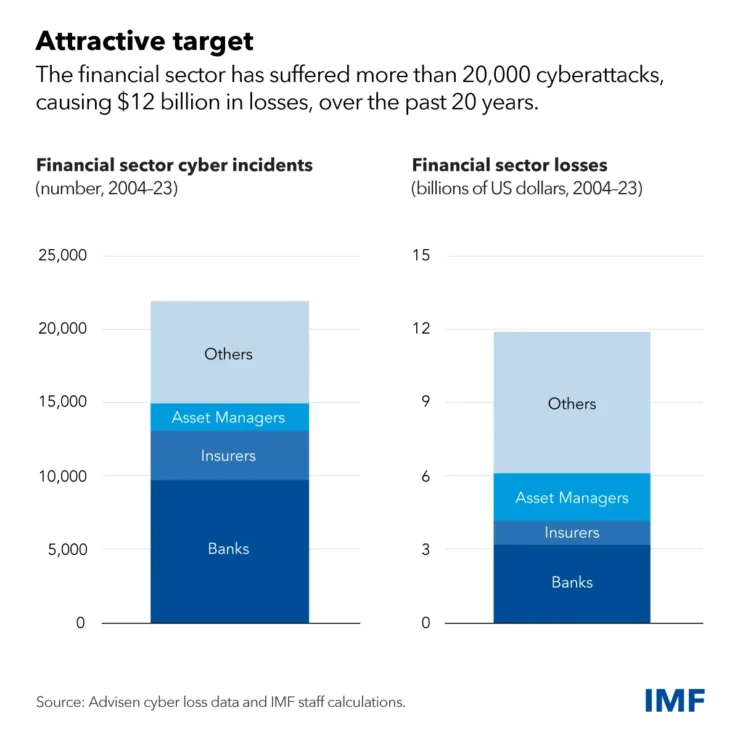

As banks collect more (and more sensitive) data from customers, their responsibility to protect it from breach or misuse grows.

In response to the ever-increasing sophistication of those seeking to acquire and misuse customer data, digital transformation has seen dramatic improvements in the protection enterprises promise to customer data privacy, security and compliance.

For most enterprises, the first step in the process of preventing cybersecurity challenges lies in understanding and streamlining their technology stack to reduce technology debt — and reduce the use of insecure and non-compliant tools.

The second step lies in sourcing new technology solutions like Riva. Designed specifically with pass-through architecture that channels data from Outlook to CRM without saving it, Riva has long supported the safe, secure, cross-enterprise unification of customer data.

And by design, Riva is uniquely capable of monitoring and applying global regulatory compliance requirements — all while protecting that data from intentional or willful misuse.

The third step, of course, lies in people. Given the right technologies, education, and incentives, committed people make smart technologies effective — and provide your enterprise with the greatest possible barrier to data breach and costly, reputation-damaging compliance violations.

Benefits of digital transformation in banking

“Market-leading banks of tomorrow will understand that technology will not limit what is possible. Instead, they will harness digital capability to put the customer firmly in control of their destination and preferred model for dealing with their bank and other service providers.”

The Future of Digital Banking, KPMG

Consumers are often intimidated by the complexities of the banking industry — and they rely on banks for help navigating their financial lives.

While banks were once seen as simple repositories for savings and financing resources for personal and business investments, they’ve evolved to meet an ever-growing list of needs, acting as both service providers and advisors.

As the role of banks has grown and the capabilities of traditional banking practices have been stretched to their limits, the benefits of digital transformation in financial services promise to improve nearly every aspect of the business — from operations, security, and compliance to product development, innovation, and customer experience.

Critical impacts of digital transformation on the banking industry

Banks are entrusted with vast amounts of sensitive data, and maintaining compliance while managing cybersecurity threats is critical. Emphasizing transparent data practices and robust privacy protocols helps foster customer trust, which is indispensable in today’s competitive landscape.

By streamlining workflows and enhancing data governance, banks can achieve substantial cost savings, optimize resource use, and boost ROI. Digital transformation isn’t just a trend but a proven strategy for achieving long-term financial gains, operational efficiency, and an agile response to market shifts.

Below we have outlined the main benefits in banking that result from digital transformation:

- Enhanced customer experience

- Operational efficiency

- Innovation and growth:

- Competitive advantage

- Enhanced security and compliance

Let’s review each of them in more detail.

Enhanced Customer Experience

Will digital transformation in banking improve customer experience? When financial services providers gather sensitive data from customers, there’s an unspoken expectation that the data will be used to improve service and results.

Through technologies that unify, improve, and leverage that data, banks are able to deliver better, more powerful, and more personal service to customers — with products that deliver measurable, predictable results.

Operational efficiency

Digital transformation has significantly enhanced the efficiency of banking operations through the use of AI and automation. This shift has eliminated many manual processes, freeing advisors to focus on customer engagement and personalize and streamline customer journeys through AI’s generative and sales engagement capabilities.

Innovation and growth

Emerging technologies — particularly AI and automation — have improved analytics, giving banks deeper, more accurate predictive capabilities that fast-track new product and service development, while amplifying each advisor’s ability to support personalized customer engagement, sales, and growth.

Competitive advantage

Banks committed to digital transformation realize efficiencies more traditional enterprises simply can’t match. Automated data unification — supported with AI-driven technologies that eliminate the errors, duplications, and omissions of manual data entry — free teams to spend less time keying and toggling, and more time engaging with customers.

Customer-facing teams can amplify their efforts using LLM generative technologies — giving them the power to enhance, accelerate, and individualize customer communications.

To further enhance productivity, tools like Riva Cadences support email cadence development with templates and automation capabilities to create, manage, execute, and monitor individualized customer campaigns.

Ultimately, these capabilities help to enhance advisor success, yield higher job satisfaction and reduce turnover — while improving customer experience and increasing transactional ROI through shortened sales cycles, stronger customer retention, and reduced cost of sales.

Enhanced security and compliance

Digital transformation technologies boost data quality and monitor regulatory changes at the regional, national, and global levels. These impacts help to boost data security and eliminate the risk of compliance violations.

Potential challenges in implementing digital transformation

As the term implies, digital transformation is all about change — and enterprise-level change inevitably comes with challenges.

But the changes associated with digital transformation in banking and financial services aren’t unique. To achieve and sustain success, change is simply the cost of doing business.

Those who face the process head-on through routine self-evaluation, open communication, collaborative problem-solving, and clear strategic planning will be well-positioned to embrace and leverage the positive attributes of digital transformation while resolving challenges in digital banking before they cause lasting harm.

“Resist the urge to throw a new tool at every problem. The most important thing when choosing a new tool is really looking at the problems you’re trying to solve. What are the most important priorities?”

Richard Giorgi, From Cold Calls to AI With Richard Giorgi, VP, Sales Enablement Business Partner at Swiss Re, Riva Rev-Tech Revolution Podcast, August 2024

Learn more: From Cold Calls to AI with Richard Giorgi, VP, Sales Enablement Business Partner at Swiss Re

Four key challenges of digital banking transformation

- Legacy systems

- Cybersecurity risks

- Regulatory compliance

- Change management

Let’s address each of the challenges one by one:

Legacy systems

Digital transformation isn’t simply a matter of adding new technologies. It’s a process of replacing legacy technologies, fine-tuning those that support the process, and retiring those that cause data and departmental siloing, data quality, and technical debt.

By streamlining technologies, banks help to focus IT efforts, grow CRM adoption, improve customer 360, and support both advisors and customers on the path to quicker, more effective transactions and higher customer lifetime value.

Cybersecurity risks

The implementation of new technologies and retirement of legacy systems requires careful oversight to ensure uncompromised data security.

Digital transformation involves the implementation of AI-enhanced activity capture and sales engagement solutions, efforts to securely transition from old technologies carry enormous ROI — bringing scalable security capabilities that keep pace with growth.

Solutions like Riva can play an essential role in reducing security and compliance risks. By automating data unification and hygiene without retaining customer data, monitoring global regulations, and governing data access and distribution, Riva provides the added measure of cybersecurity that banks need — and customers expect.

Regulatory compliance

Banks reliant on traditional systems and practices are already structured to ensure regulatory compliance. In a case of “why fix what’s not broken,” inertia may make the transition to new, AI-powered compliance technologies seem like an unnecessary risk.

But as the financial industry moves toward ubiquitous digital transformation, legacy systems simply can’t keep up — making the shift to new tech essential.

And while the challenges of that transition are real, careful planning, collaboration, and communication can alleviate the risk of non-compliance while bringing the benefit of new technologies designed to significantly boost compliance oversight.

Change management

Digital transformation can only succeed through adoption — and adoption requires a clearly articulated strategy, ongoing communication, training, and detailed timelines.

As technologies and strategies shift from legacy systems and traditional practices, well-prepared management and advisors are better positioned to see progress against objectives — and to recognize the long-term benefits of short-term disruption.

Once workers recognize those benefits, including improved customer 360, heightened productivity, and greater opportunity for compensation and personal growth, both advisors and customers reap the rewards.

Digital banking transformation case studies

Long before the term “digital transformation” became common parlance, progressive-minded banks were taking the first steps toward what would eventually become an industry-wide movement.

Recognizing early signs of customer data’s enormous potential, these companies embraced new tools and strategies to unify that data. They pioneered the use of emerging technologies like business intelligence, predictive analytics, cloud computing, and consumer engagement products to improve productivity, build customer relationships, and outpace competitors.

“Building an entire architecture of responsible usage of data is not easy. We are focused on enabling employees to think of data first and empowering them with the capabilities and tools to effectively use data and analytics while making decisions.”

Sameer Gupta, Group Chief Analytics Officer, DBS, (quoted in Transforming a Banking Leader into a Technology Leader, Mckinsey Digital)

The question, of course, is how those bold new technologies and strategies actually worked.

Let’s explore the experience of a couple of early digital transformation adopters — and take their hard-earned lessons to our banks.

Case 1: Capital One and impact on its services

As a forward-thinking bank with a global reputation for innovation, Capital One was early in the digital transformation game.

Because of their demonstrated commitment to new technologies and strategies, they didn’t face the challenge of catching up to industry peers. They did recognize the need to sustain their leadership position in the face of aggressive competition.

In Case Study: How Capital One’s Digital Transformation Sets New Industry Standards, Salma NILI reviews a number of areas where the bank’s digital transformation strategy had already yielded significant impact, including:

Digital innovation

Capital One moved aggressively to enhance its mobile banking services, voice-activated banking, and AI learning applications, seeking improvements in service delivery, security, productivity, and data analytics.

Customer experience

Digital transformation shouldn’t mean dehumanization. Capital One’s introduction of new hybrid Cafes encouraged customers to engage directly with bank advisors in specially designed spaces — while leveraging technologies to enhance human experience.

Technological infrastructure

Digital cafes notwithstanding, Capital One eliminated its primary reliance on physical service centers and transitioned to cloud-based data operations — boosting efficiency and scalability while enhancing analytics and cybersecurity.

Thanks to Capital One’s growing commitment to digital transformation, these initiatives have contributed to significant growth and sustained leadership.

Still more important, however, was the bank’s eagerness to continually learn, to refine data-driven, customer-centric strategies, and to seek promising new growth paths.

AI expansion

The bank continues to pursue its commitment to AI — seeking to provide greater personalization and automate processes, enhancing both customer experience and digital banking operations.

Expanded access for underserved communities

The bank is leveraging AI and automation to simplify financial products, improve digital literacy, and broaden access to its services.

Sustainability-focused investment

Recognizing the win-win benefits of sustainable investment products, the bank is moving aggressively to offer more eco-friendly products like green loans and environment-friendly investments.

Case 2: Supporting customer-centric strategy at a regional bank

Faced with the challenges of aging technology, maintaining customer trust, and remaining competitive, a regional bank turned to Ernst & Young for guidance. As detailed in the consulting firm’s case study, the team recognized the bank’s need to:

- Simplify existing processes to increase productivity — and speed to market;

- Increase availability of data to better inform business decisions and improve customer experience;

- Resolve legacy system challenges with new technologies, while eliminating the inefficiencies of outdated and underused applications;

- Improve data production and consumption efficiency to reduce the cost of operations;

- Strengthen risk management using automated controls.

In short — like so many regional banks — the Ernst & Young client had long relied on systems and practices that no longer served the needs of its employees, customers, or objectives. Faced with increasing competition from banks that had embraced digital banking transformation, this regional player recognized the need to follow suit.

In response to the bank’s needs and the growing demands of the marketplace, the consulting team went to work on key priorities. They focused on process improvements. They identified and implemented new technologies.

Through these efforts, the bank started to see the benefits they were seeking. In just the first year of their five-year digital transformation plan, the bank already recognized:

- streamlined workflows

- enhanced support for cross-enterprise data availability

- security and compliance risk reduction

- improvements to new product development

- enhanced worker productivity.

While the investment of time and effort would continue, the returns were already outpacing expectations — putting the bank in a better position to compete with its market peers.

Key takeaways

As these case studies clearly demonstrate, digital banking transformation requires commitment. It also requires deliberate, detailed, transparent planning.

In both cases, the challenges of improving data quality, data availability, internal operations, customer engagement, security and compliance, and worker productivity demanded holistic solutions that addressed both process and technology deficiencies.

In these instances, the banks recognized that digital transformation was imperative for long-term success.

And while digital transformation in banking required significant investments of both financial and human resources, they were essential to success and survival — and the promised returns more than justified the cost.

The future of digital transformation in banking

“It’s not a question of “how much digital transformation will accelerate in 2024, but what form it will take”.

Kevin Pettet, COO of Banking Solutions at Bottomline (cited in Louis Thompsett, “Digital Banking Transformation: Accelerating into 2024”, Fintech Magazine, 5 January 2024)

Based on the technologies and strategies gaining traction today, it’s safe to assume digital transformation in banking will continue to drive:

1. Expanded AI integration

Banks are now at the forefront of the AI revolution, and while the technology has already resulted in enormous improvements to data unification, data quality, predictive analytics, and generative tools, those impacts will likely show continued evolution and growth — alongside new developments that will further enhance personalization, security, and productivity.

Related: Navigating the AI Frontier: Trust, Transformation, and the Future of AI in Business with Marc Low

2. Emerging digital currencies and currency technologies

Other AI-assisted technologies are fueling the development of Decentralized Finance (DeFi), Central Bank Digital Currencies (CBDC), and Distributed Ledger Technologies (DLT) which, along with Blockchain, promise radical changes in the very nature of money — from how it moves to how it’s secured and used.

3. Enhanced security

Emerging technologies like biometrics are already becoming commonplace, further complicating hackers’ efforts to breach bank security. Rapidly advancing AI-powered predictive analytics will further enhance security and compliance by anticipating potential security weaknesses — resolving threats before they’re exploited.

4. Banking’s seamless integration in everyday life

With the shift toward remote work, the development of mobile and wearable technologies has made it possible to remain connected from literally anywhere. These advances reduce emphasis on brick-and-mortar bank branches, and on desktop and laptop applications — yielding to cloud-based technologies that enable banks to serve customers through channels and tools that fit customer lifestyles.

Advanced predictive analytics capabilities will further enhance banks’ ability to anticipate customer needs — and deliver solutions on their terms.

Conclusion

It’s clear that digital transformation in the banking industry isn’t just the future: it’s happening now. Fueled by technological advances like AI, automation, mobile devices, and digital payments, digital transformation is accelerating in response to customer expectations, regulatory changes, and intensifying industry-wide competition.

But transformative change comes with challenges — and implementing new technologies and strategies requires careful planning, consistency, and commitment. From retiring legacy systems and embracing CRM-based customer 360 to new tech adoption and adaptation to AI-enhanced customer engagement, digital banking transformation is an evolving process.

By establishing and executing a clear strategy and remaining vigilant for innovation, your bank will be ideally positioned to seek the right solutions, maintain competitive advantage, and realize returns that far outperform digital transformation investment.

Working with solutions like Riva Activity Capture and Sales Engagement, banks can simplify the digital transformation process — paving the way for improved data quality, enhanced security and compliance, heightened worker productivity, enhanced customer experience, and the steady growth of customer lifetime value.

To stay ahead, banks must address compliance, data security, and customer engagement in one streamlined solution. Schedule a demo with our team to see how Riva’s tailored technology can help solve your institution’s most pressing challenges, or learn more about Riva’s service offering for financial organizations.