No matter what industry you’re in, you’re increasingly reliant on the vast volumes of customer and deal data you gather from interactions in the course of business. And with very few exceptions, much of that customer data is sensitive enough to trigger data security and compliance responsibilities for your enterprise.

No two enterprises are exactly alike—and success is highly data-dependent if you’re in an industry like financial services, healthcare, pharmaceuticals, and education. By gathering that data, your enterprise forms formal and informal contracts with customers, giving rise to an important responsibility to govern its use carefully.

In some cases, governmental regulations define that responsibility—think material non-public information (MNPI) and General Data Protection Regulation (GDPR)—which impose strict limitations on how and by whom customer data is accessed and shared, with hefty fines as penalty. In other cases, the enterprise is answerable solely to its customers. When that’s the case, the use of customer data is bound by trust and corporate policy. In either case, breaches harm customer relationships and enterprise reputation.

The critical role of data governance

For enterprises in regulated industries, the importance of data governance is heightened. To maintain good governance, it’s essential to institutionalize effective protocols for monitoring and auditing ongoing data usage.

Like any enterprise-wide endeavor, this requires careful oversight, consistency, and diligence. To aid your pursuit of smart data governance, we’ve assembled a short list of best practices. While they’re more common sense than rocket science, many enterprises miss the forest for the trees—often overlooking data housekeeping fundamentals when implementing new technologies.

Over the years, we’ve learned a lot from our customers. Here’s a list of best practices we’ve compiled from the leaders in financial services in their successful bid to tackle their data governance challenges:

Over the years, we’ve learned a lot from our customers. Below you can find a list of best practices we’ve compiled from the leaders in financial services in their successful bid to tackle their data governance challenges.

Best practices to tackle data governance challenges in financial services

1. Commit your enterprise to a single source of truth

When enterprise end-users access customer and deal data across multiple platforms and applications, monitoring and auditing data use is a lot like cat herding. Creating an architecture with a single source of customer truth must be a design imperative.

In concept, most enterprises embrace this notion, pinning their hopes and expectations on the promise of CRM to magically deliver a customer 360. In reality, CRM implementation is a step in the right direction—but it’s certainly not a “get it and forget it” solution. For CRM to fulfill its potential as your enterprise’s single source of truth, you’ll need the means to unify the data your end-users gather through CRM and communications platforms like Outlook. That’s where a proven customer data ops solution can make a world of difference.

Customer data ops solutions like Riva are the missing link between your CRM and communications platforms. By unifying the customer data across revenue and communications platforms, automating data governance, and distributing data to authorized users when and where they need it, customer data ops allows enterprises to realize their customer 360° objectives

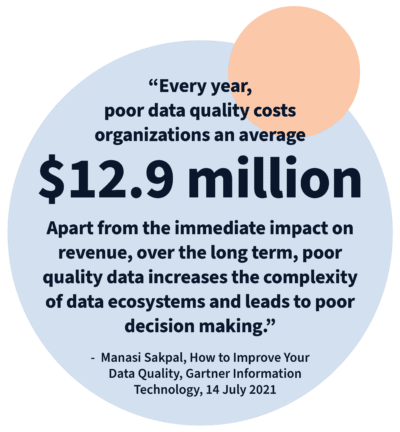

2. Prioritize data quality

When enterprise data quality is poor, even the best-intentioned attempts at data governance will inevitably come up short. Think about it: when inaccuracies, duplications, and omissions compromise customer and deal data, it’s challenging to know which reality end-users see. And when data quality is low, discerning the “truth” is nearly impossible—damning to failure any efforts by administrators and managers to successfully monitor and audit data use.

For most enterprises, the pursuit of data quality is an ongoing challenge. Because data comes from a growing number of sources—CRM, communications platforms, single-purpose revenue applications, and data lakes to name a few—the priority is to unify siloed data. This is a task uniquely suited to customer data operations, which work behind the scenes to aggregate data—preventing the need for end-users to re-enter data gathered in the platforms they use every day, like Outlook email, calendars, and contacts to CRM. Customer data operations automatically transfer interaction data to CRM, and data quality climbs.

3. Incentivize CRM adoption

As most enterprises can attest, CRM adoption poses a chicken-and-egg conundrum. As primary data-gatherers, customer-facing teams are integral in capturing data that makes CRM effective. But customer-facing teams will only adopt CRM if the data it provides is trustworthy. In short, good data is good for adoption—and bad data impedes the high data quality that makes CRM effective.

In a perfect world, the promise of better, more trustworthy data would incentivize end-users to embrace CRM. But in the real world, adoption rates often benefit from encouragement. In most situations, that encouragement comes from metric-based incentives, where end-user CRM patterns are tracked. Those demonstrating high-quality engagement earn anything from team recognition to variable compensation. And for those situations where positive reinforcement doesn’t produce desired results, there may be a need to institutionalize CRM use expectations—and assign consequences for those whose performance fails to measure up.

From a data governance perspective, CRM adoption represents just one of many variables that can boost or impede efforts to monitor and audit data use. But without high levels of adoption, efforts to establish and maintain CRM as the single source of truth will fall short, data quality will suffer, and effective governance will be more difficult to achieve.

4. Facilitate data observability

The concept of data governance involves a lot more than simply gating data. Ultimately, it’s a process of continuous improvement, where efforts to improve data flow and quality go hand-in-hand. That’s why data observability is critical to successful governance. To ensure the right data is going to the right places at the right time, administrators and managers need to be able to see it to ensure that errors and inconsistencies are caught before their impact grows to create larger, more systemic problems for the enterprise.

When working with a proven customer data operations solution like Riva, admins, managers, and even customer-facing teams can nip data issues in the bud. Riva’s integrated Insight side panel, for example, allows users to review customer data currently on file—and to make corrections and additions that are then reflected across critical enterprise platforms. Comprehensive data observability also allows admins and managers to identify positive and negative data trends automatically, and either embrace effective practices or intervene in those detrimental to overall data quality.

5. Avoid application creep

Teams in enterprise environments are intimately familiar with the pain points that impede their ability to perform. And while that level of nuanced awareness is important, it’s often tempting to seek single-purpose applications to fit their needs—without weighing their impact on the rest of the organization. But more isn’t necessarily better when it comes to technology applications in an enterprise environment.

Each time a team integrates a new application, it adds to the burden of those IT teams responsible for maintaining enterprise technology. In nearly every case, new applications represent new data sources that may or may not integrate with other platforms and applications—ultimately compounding the looming threat of technical debt. In the short term, the need for single-purpose applications can signify larger shortcomings with enterprise technology—acting as canaries in the coal mine for issues that could, over time, result in more systemic data issues that could result in profound complications for everyday business operations.

By assessing technology needs holistically and avoiding the temptation to embrace quick fixes for specific lines of business, enterprises are much better positioned to identify solutions like customer data operations that serve multiple needs throughout the organization. This practice helps alleviate burdens on overtaxed IT departments, allowing them to focus on pursuing shared business objectives. What’s more, by thoughtfully embracing holistic solutions, the enterprise is better positioned to ensure data unification and governance.

6. Reduce employee turnover

You read that right: employees who understand the importance of data quality are invaluable assets in the pursuit of effective data governance. Once employees acclimate to systems that encourage good data practices, their efforts help to ensure that enterprise data processes work. They understand that their data stewardship helps both them and their peers. They appreciate the gratification of accessing trustworthy data to help grow customer relationships and sales. And because they’re part of an effective process, they ensure that governance efforts are supported by good data—helping to ensure that monitoring and auditing efforts are more about proactive fine-tuning than reactive problem-solving.

Summing up

Like so many challenges enterprises face, effective data governance doesn’t lend well to a quick fix. Governance must be approached holistically to be effective—and to deliver the measure of monitoring and auditing necessary to identify data quality issues, enforce positive end-user behaviors, and ensure data security and regulatory compliance. By employing technologies like revenue data operations and encouraging and enforcing cultural behaviors that continually support data quality, enterprises can improve data governability—paving the way for reliable data security, compliance, and usability.

Whether you’re in financial services, healthcare, government, education, or any other industry where data security and compliance are mission-critical, you already appreciate the importance of data governance—and data quality. In a study commissioned by Riva, Forrester Consulting found that Riva’s ability to unify, govern, and distribute data to end-users results in efficiency improvements that significantly reduce the time and resources necessary to accurately capture revenue and communications data—leading to marked improvements in the data quality necessary for effective governance. Learn how Riva demonstrated a 352% ROI over three years—and how we can help your enterprise in its pursuit of nimble data monitoring, auditing, and governance.