There’s a good reason financial services customers have some of the highest service standards of any industry: their wealth is on the line. Because of those high expectations, few workers are under more pressure to perform than financial advisors. From one organization to the next, these customer facing employees are responsible not only for their customers’ portfolio performance—but for representing their entire enterprise. Given the intensity of these roles, it’s only natural to assume they have access to the highest quality, most trusted data—and the best-designed, most intuitive technological tools available in order to do their jobs.

The trouble is—in many cases—they don’t.

Because of the sensitivity of their work, financial services enterprises are notoriously cautious about taking on new technology initiatives. The cause is often understandable, ranging from the mundane (”if it ain’t broke, don’t fix it”) to the existential, as new regulations force constant upgrades that often reflect more triage than long-term strategy.

Today’s Financial Services enterprises are facing additional pressures from within. As tech-wary baby boomers begin to cede their positions to growing numbers of Gen-Z workers who expect consumer grade applications at home and at work. As these new workers claim their place in the workforce, their disdain for antiquated technologies is driving them to seek employers whose tech meets their expectations. In a competitive employment environment, Financial Services firms with modern technology have a clear hiring and retention edge.

Identifying the challenge: how aging tech hampers hiring appeal

“So many firms are right now in the throes of trying to evolve from a wealth management 1.0 model to a wealth management 3.0 model,” says Michelle Feinstein, Vice President of Global Wealth Management Solutions & Strategy at Salesforce. The challenge, of course, is that systemic transitions are a lot like bringing a loaded supertanker to a stop: both require time and careful planning. “There is a lot that’s involved in doing that, because it affects people, process, technology, culture, the way you do development, becoming more nimble and agile, many different things.”

It’s not difficult to identify the hallmarks of a firm with a financial services 1.0 platform, which can include:

- Outdated Technology

Many financial services firms rely on servers, platforms, and applications that are a decade or more behind the state of the art. - Compromised Client Service

As customer expectations grow with the standard of care delivered by tech-savvy b2bs and b2cs that have integrated revenue operations and advisor-friendly work platforms, their patience for fragmented interactions grows thin. - Growing Advisor Frustration

Advisors are consumers, too—and they’re aware when other firms have invested in technologies and processes that allow them to more effectively serve their clients’ needs. They feel hobbled by antiquated tools and low quality data. They want to succeed, to feel great about what they’re able to offer to clients, and to add value—not just sell.

The high cost of living on the FinTech past

Whether a firm actively decides to delay systemic upgrades or simply chooses to ignore the disadvantages of being a rev tech have-not, the impact of inaction is the same. Michelle Feinstein sums up the situation: “Many advisors now are starting to see the next gen of advisors coming into wealth. They’ve all grown up with technology; they don’t know how to communicate any other way. So when they come in, they have high expectations that they’re not going to be doing a lot of manual processing. They’re going to be able to engage with their client anytime, anywhere, and share data easily. And so if they cannot, they will quickly leave and hop to the next wealth firm that is more modernized.”

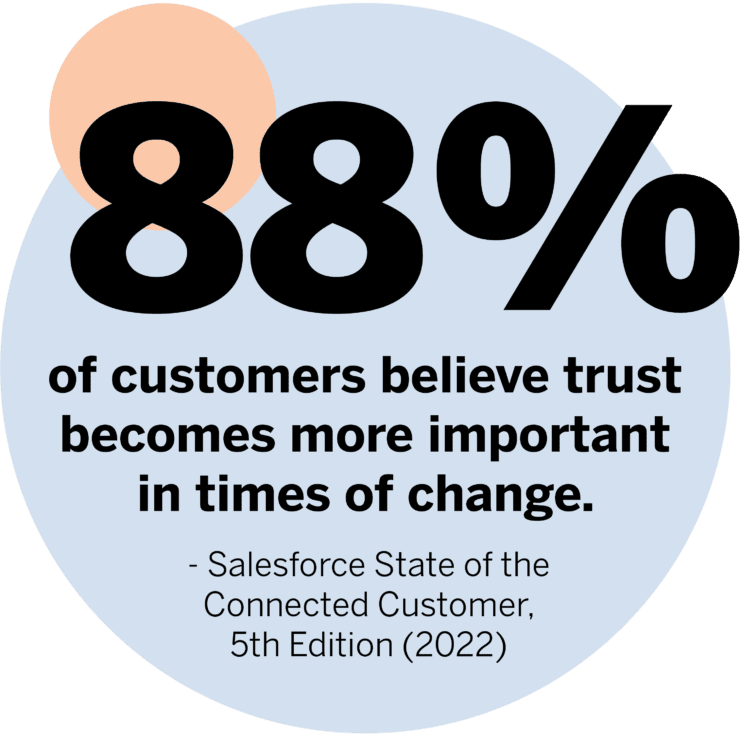

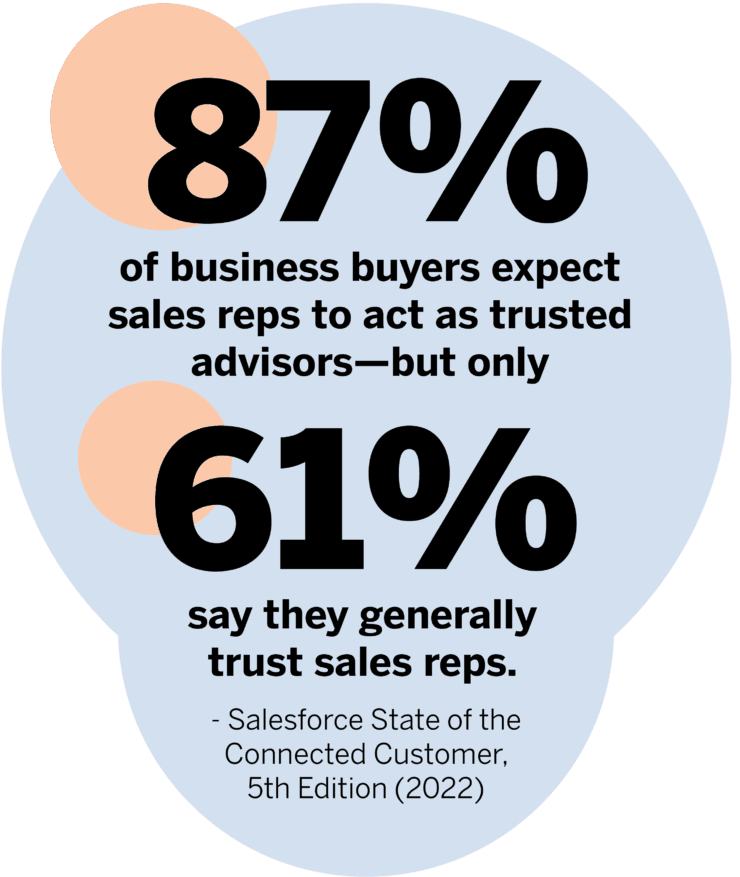

Even the most reluctant firms can’t halt the inevitable. Customer expectations will continue to grow in the transition to a trust-based economy. They expect firms to know, understand, and provide stellar service—and they quickly lose trust in enterprises that don’t deliver.

Advisors, in turn, want to be able to deliver on those expectations—and to build and sustain the trust customers expect. Accordingly, advisors want technologies that:

- Support open, honest, and transparent engagements

- Use customer history data responsibly

- Support engagements that treat customers as people—not numbers

- Resolve issues proactively

- Understand new customer opportunities and communicating them proactively

- Communicate solutions proactively

- Salesforce State of the Connected Customer, 5th Edition (2022)

Absent significant investment in new technologies, streamlined processes, and commitment to a customer-centric culture, pressure on advisors to pick up the slack will increase. It is not uncommon for an advisor to have 5-10 tabs and just as many applications open as they serve one customer. The kind of deep attention a client demands from their advisor is nearly impossible to deliver. And, if they are regularly dealing with bad, incomplete, or inaccurate data – it means not just embarrassment, but a loss of trust.

“Some firms have not changed out their servers and their technology for 10 years, and they’re finding that that tech doesn’t work with some of the new FinTech capabilities with AI, with public cloud capabilities and more. And so that foundational change has to be made before they can start to take advantage of some of the sexier technology.”

Michelle Feinstein, Gaining Trust as a Brand With Michelle Feinstein of Salesforce, Riva Rev-Tech Revolution Podcast

3 steps to making the financial services 3.0 transition—and reducing advisor and customer churn

Increasingly, your organization’s success relies on its willingness to invest in the technologies and processes critical to both advisor and customer satisfaction. But knowing is only half of the game—doing is essential to ensure success. With that in mind, here’s how you bring the transition home:

1. Establish a data council

While most think of technology as a democratizing change agent, real systemic change requires C-level buy-in and support, in the form of Data Council. Operating with that endorsement, data councils seek to reduce departmental siloing by evaluating data and technology initiatives from a holistic, enterprise-wide perspective.

2. View your enterprise from the outside In

It’s vital to look at your enterprise first as a customer seeking a trustworthy resource, then as an advisor who wants to serve the customer with good, current, comprehensive customer data, housed in platforms that offer clear, consumer-level UIs. Their needs should drive the search for effective enterprise rev ops, tech platforms, and processes.

3. Improve the quality of data available to advisors

Customer trust is only possible when advisors can trust the revenue and comms data they rely on to inform engagements. To attain that level of trust, smart FinServs are researching and integrating rev ops solutions that unify, govern, and distribute customer data where and when advisors need it. When advisors consistently see high-quality data in their day-to-day interactions—as confirmed by their customers—they’re able to pursue their objectives confidently and effectively.

By giving advisors intuitive tools informed by high-quality data, FinServs can create a success loop that grows satisfaction-based customer retention—and offsets the necessary costs of new customer acquisition.

Summary

While there’s invariably some risk in an investment to bring FinServ advisor technologies and processes into the present, the risks of not making that investment means you’ll endure increasingly high rates of both advisor and customer churn—along with the exorbitant costs of hiring, lost business, and new customer acquisition.

So take the initiative. Be the agent of change. And help your firm make the shift to Financial Services 3.0.

Latest Articles

- What is Agentforce? Salesforce’s AI Agents Explained

- Digital Transformation in Banking: Trends, Challenges, and Future Insights

- Three Key Takeaways from Dreamforce San Francisco 2024

- What is AI Copilot in CRM: Detailed Guide with Examples

- Building a Strong Network of Salesforce Professionals at the Nebraska Summit