In nearly every industry — from financial services and healthcare to education and manufacturing — the effort to successfully, securely harness and leverage customer data has reached a fever pitch. Despite the seeming simplicity of that goal, the pursuit of unified, comprehensive, current customer 360 involves a number of challenges, including:

- Unification of the right data and Customer 360, refining reliable signal over noise to ensure data quality.

- Integration of quality data into the right systems, ensuring its ready availability where and when it’s needed.

- Building and sustaining advisor and seller trust in customer data to ensure the adoption of “single source of truth” CRM.

- Ensuring security and compliance of customer data use, particularly when working with tech stack tools outside of CRM and communications platforms.

- Limited availability of streamlined tools to amplify digital customer experience and follow-through for advisors and sellers

Due to the sheer volume of customer data captured during everyday business operations, advisors often struggle with systems that don’t contribute to and sustain customer 360. As a result, advisors and sellers lose trust in customer data, struggle with inadequate tools for effectively engaging with clients, and remain concerned about ongoing customer data security and compliance risks.

While companies in industries like financial services have made strides in addressing some of these issues, there’s still a lot of work to be done to capture all advisor and seller activity, separate signal from noise, and boost data quality.

Fortunately, the demand for solutions to these historic challenges is prompting action — and yielding real promise. Technology companies have introduced new technologies to address customer 360 shortcomings, with the most effective solutions delivering on the need to unify, govern, and curate customer data assets —making them uniquely suited to enhance sales engagement. Those benefits include:

- Increased scope and accuracy of data-driven analytics

- Elevated, personalized customer experience

- Growing data trust and CRM adoption

- Increased customer lifetime value

- Enhanced data security and compliance

Diving deeper: 5 ways to master customer 360 and client engagement

With the blazing-fast embrace of powerful AI-enhanced technologies, solutions like Riva have brought the benefits of trusted customer 360 and advisor/seller workflow automation within reach. Here’s how solutions like Riva make true, trustworthy customer 360 a sales engagement game-changer for financial services firms like yours.

1. Increased Scope and Accuracy of Data-Driven Analytics

Predictive analytics are only as good as the data from which they’re derived. Until recently, data integration technologies have fallen far short of aspirations to effectively overcome customer data capture errors, omissions, and duplications. As a result, analysis suffered from inherent data quality issues, ultimately compromising the reliability of backward-looking trend identification and forward-looking predictions.

“In Portfolio Management, predictive analytics enables asset managers to optimize investment strategies by forecasting market movements, identifying investment opportunities, and managing risk more effectively.”

Ekkarit Gaewprapun, Predictive Analytics: Transforming Risk Management in Finance, LinkedIn, 4 March 2024

Through the integration of AI-enhanced technology, solutions like Riva Activity Capture significantly improve data quality by eliminating data gaps and errors and prioritizing signal over noise. As a result, financial services firms that implement these solutions have seen dramatic improvements in analytics by leveraging AI’s ability to process vast volumes of data to recognize business-critical patterns. When fueled with high-quality data, AI’s pattern recognition capabilities can predict customer behavior, identify fraud, automate ad targeting, and identify product and process defects and safety issues.

AI can also utilize that data to deliver highly accurate market trajectory predictions to boost sales engagement. Advisors and sales team members can then utilize data-driven insights to fulfill their role as both sellers and advisors — which in turn build customer relationships and bolster customer confidence.

2. Automated Advisor and Seller Workflows for Personalized Customer Experience.

When advisors and sellers have data they trust and tools they need to fuel customer engagement, everyone wins. At a time when these customer-facing employees are facing heightened productivity expectations, access to trusted customer 360 is a critical starting point. Just as important, however, is access to tools that streamline workflows — and leverage AI and automation to simplify customer engagement on customers’ terms.

Solutions like Riva Sales Engagement suite are designed specifically to help advisors and sellers communicate the right message to customers at the right time and through the right channels. From automated cadence creation and delivery and real-time, in-media calendar booking to AI-enabled LLM content creation, Riva amplifies each advisor’s reach — and ensures that customers receive personalized communications on their own terms. As a result, tools like Riva boost advisor and customer confidence in the enterprise, helping to improve customer relationships and customer lifetime value.

3. Growing Data Trust and CRM Adoption

Despite the shift toward increasingly data-driven customer and prospect engagement, financial services firms still rely on advisors and sales team members to establish, cultivate, and maintain customer relationships. As the push toward CRM as a single source of truth has accelerated, these frontline staffers still rely in some significant part on one-on-one customer engagement.

Financial services firms have viewed CRM as the most powerful tool in these workers’ arsenals. By providing advisors and sellers with access to consolidated, complete, current, and accurate customer histories, these staffers should have comprehensive customer information to understand each customer’s status quo — and to advance the sales process. But all too often, shortcomings in data integration processes and technologies have compromised the push for high-quality customer data — and compromised the ability of CRM to deliver trusted customer 360.

As a result, advisors and sellers have been reluctant to adopt and rely on CRM as their single source of customer truth. This has led to halting one-on-one engagements, where customers are repeatedly asked for information they’ve already provided, and sellers present information that’s rife with gaps and inaccuracies. This, in turn, has compromised employees’ trust in available customer data, resulting in chronic resistance to CRM adoption despite incentives and mandates designed to compel its use.

With the advent of AI-enhanced activity capture and seller workflow automation solutions like Riva, automated data capture, unification, and governance have produced dramatic improvements in the quality of customer data consolidated in CRM. These powerful technologies help to:

- Eliminate data gaps

- Prioritize signal over noise

- Reduce scheduling friction

- Optimize customer engagement

These capabilities serve the dual purpose of boosting employee confidence in CRM’s ability to deliver trusted customer 360 and nurturing customer confidence in financial services firms to understand and address their needs.

On the customer engagement front, solutions like Riva have helped advisors and sellers amplify their efforts — enabling them to leverage digital experiences at scale and multiply their customer engagement efforts from 1:1 to 1:many.

“Just like with other data types and methods, data quality will be an ever-present concern for AI processes and the data that feeds them.”

Emanuel Younanzadeh, Data Quality is Also an AI Problem, Forbes, 13 November 2022

Using data-driven insights, today’s financial advisors and sellers can begin the sales process with 1:1 contact — and amplify productivity through AI-enhanced content and cadences that sustain the sales process between 1:1 contacts. This means customers are able to remain engaged on their own terms through their preferred platforms — giving them the information they need to ensure subsequent 1:1 engagements are richer, more meaningful, and more effective at presenting relevant solutions and shortening the selling cycle.

“80% of customers say customer experiences should be better considering all the data companies collect.”

State of the Connected Customer, Salesforce, 8 August 2023

As a result of the AI-enabled data quality improvements, FIN advisors and sellers gain a growing sense of trust in the data available in CRM. And as that trust grows and transactions close, customer-facing teams increasingly turn to CRM as — you guessed it — their single source of trusted customer 360.

4. Increased Customer Lifetime Value

Customer experience, of course, is inextricably linked to enterprise success. When companies deliver on—and ideally anticipate—customer expectations, they’re uniquely positioned for sustained success. So it’s only natural that transformative positive impacts on customer experience will promise transformative positive impacts on revenue growth. Here’s how revenue operations’ effects on customer experience translate to bottom-line enterprise performance:

“65% of customers expect companies to adapt to their changing needs and preferences.”

State of the Connected Customer, Salesforce, 8 August 2023

- Gains in customer retention. Businesses universally recognize the economies of customer retention versus customer acquisition. By arming go-to-market teams with detailed, current customer histories, customer-facing teams can meet and exceed customer expectations, keep them coming back, and reduce unnecessary acquisition costs.

- Growing customer lifetime value. As the duration of customer relationships grows, businesses open the door to recurring sales opportunities that boost customer lifetime value.

- Reduced customer acquisition costs. While customer acquisition is an ongoing priority, retained customers don’t need to be re-acquired. This reduces the cost of acquisition efforts, and ensures that new customers represent additions to bottom-line performance—not recovery of lost sales opportunity.

- Enhanced cross- and up-selling ability. When go-to-market teams have accurate, current, and comprehensive customer histories, they’re better positioned to recognize opportunities for up- and cross-selling—magnifying the effectiveness of every interaction and driving higher revenue potential.

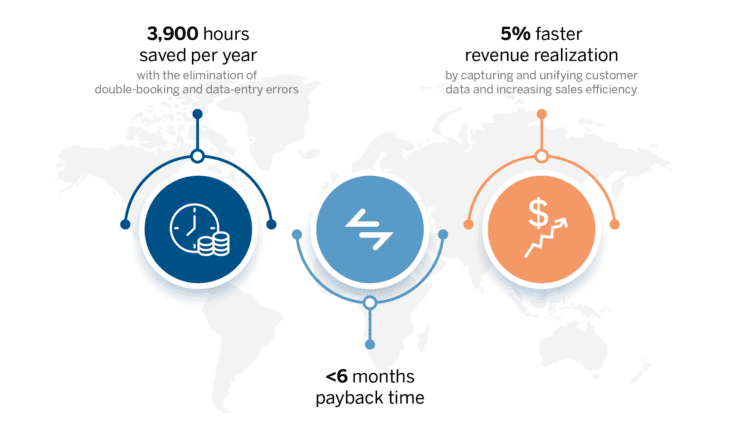

In a Riva-commissioned study, Forrester Consulting modeled a composite corporation to measure the impacts of Riva’s revenue operations solution over a three-year period. The results were remarkable—reflecting the transformative potential enterprises could realize by implementing and embracing revenue operations. The study demonstrated:

- 352% ROI

- 6-Month Return

- 5% faster to close a deal

- $5.84 Million NPV

- $3.7M Time Savings on Calendar/Email Sync

- $3.4M Profit Increase due to productivity lift

- $412.2K Time savings through the elimination of double-booking errors

5. Ironclad Data Security, Privacy, and Compliance

Few industries are more reliant on customer trust than financial services. And given the potential risks to customers presented by poor data security, few industries are more heavily regulated to compel it.

As financial services firms can attest, data quality is central to the security of sensitive customer data — and to regulatory compliance. With the advent of AI-enhanced activity capture solutions like Riva, the ability to support data quality, data security, and compliance is more attainable than ever before. To achieve those objectives, Riva Activity Capture offers:

- Pass-through technology. Unlike many integration solutions, Riva seamlessly and automatically transfers customer data from email, calendar, and contact platforms like Outlook to CRM without retaining data. This unique capability is particularly important to compliance-minded financial services firms for its ability to reduce the risk of data breach and satisfy elevated regulatory data stewardship regulations intended to protect sensitive financial information from unauthorized access.

- CRM-centralized customer data access. Through the realization of CRM as the single source of customer truth, financial services firms are better able to monitor and control access to sensitive customer data — a reality further enhanced through the use of administrative controls to govern not only who has access to data, but what users can access and use. Unification in CRM also reduces the risk of inadvertent or malicious data access and use by unauthorized parties.

- Improved data observability. Through the use of sophisticated, highly flexible administrative controls, solutions like Riva permit deep, ongoing data observability — helping to ensure data quality, monitor user activity, and customize access permissions to bolster security and compliance.

- AI-enhanced data analytics. With AI-enhanced technology capable of unifying and processing enormous volumes of customer data, solutions like Riva Activity Capture are uniquely suited for informing and performing data analysis. While this capability dramatically improves predictive analytics, it can also identify data trends that could trigger or signal security and compliance risks, enabling quick, targeted remedial action.

Summary

Like other enterprises, financial services firm growth depends on building and sustaining strong customer relationships. But given the high stakes of the work they do, financial services firms must go above and beyond to continually earn customer trust. That objective is reliant on uncompromising data quality — and on the technologies these companies employ to put that data to use in customer engagement initiatives.

AI-enhanced revenue operations technologies like Riva resolve those issues. Designed to automate data unification and governance, these solutions capture data where it’s gathered and apply AI to eliminate siloing by processing data as it’s captured by advisors and sellers and transferring it directly to CRM. While seemingly simple in concept, solutions like Riva perform a range of mission-critical tasks behind the scenes. Far from simply moving data from point A to point B, these technologies leverage AI to improve that data before it reaches its destination — eliminating errors, duplications, and omissions to ensure data quality and boost data trust.

To learn more about the amplifying power of Riva’s relationship and sales engagement platform — and to see how it can empower your client advisors and sales teams — we encourage you to contact us for a full demo.

Recent Posts

- Guide to Einstein Activity Capture: All You Need to Know

- 2024 Bankers Summit: 5 Key Takeaways

- Financial Services: Mastering Customer 360 and Client Engagement for Increased Customer Lifetime Value

- Dreaming Big at Salesforce Education Summit San Diego 2024

- How to Build a Sales Cadence in 2024: Examples and Best Practices